Carlson Wagonlit Travel has named Brennan its vice president of hotel operations. He most recently served as vice president of field partner management of QSI Facilities.

Carlson Wagonlit Travel has named Brennan its vice president of hotel operations. He most recently served as vice president of field partner management of QSI Facilities.

Pittion is now executive assistant manager of F&B for Sheraton Grand Macao Hotel, Cotai Central and The St. Regis Macao, Cotai Central, having moved from Mandarin Oriental, Hong Kong where he was director of F&B.

Oakwood Asia Pacific has appointed McKie as the new general manager of Oakwood Premier Cozmo Jakarta. He was most recently general manager of Nine Dragons HNA Hotels in Zhejiang, China and was responsible for the Nine Dragons Resort Complex. His extensive career spans 20 years.

Tan now leads Pan Pacific Hotel and Serviced Suites, Ningbo as general manager, having moved from Copthorne Tara Hotel London Kensington where he was also general manager.

Conrad Seoul has named Moore its director of business development. He joins from Hilton Beijing where he held the same title.

From left: An event in Helsinki; a Finnish sauna

From left: An event in Helsinki; a Finnish sauna

While Finland is no stranger to MICE groups, it has been dealing mainly with a European clientele. This, however, is set to change with a recent heightening of efforts to court Asian markets. Rachel AJ Lee reports

Finland wants more Asian MICE groups to visit, a message that inbound players are broadcasting through their recent efforts.

This is evident in the 90 per cent increase in exhibition space taken by Finland at ITB Asia in October 2016, where various local destination bureaus, hotels and DMCs were in attendance.

Heli Mende, head of global sales promotion, Visit Finland, said: “We also organised our own roadshows in China in May, and in South Korea, Japan and Taiwan in September, bringing Finnish companies along with us.

Heli Mende, head of global sales promotion, Visit Finland, said: “We also organised our own roadshows in China in May, and in South Korea, Japan and Taiwan in September, bringing Finnish companies along with us.

“(While these roadshows are leisure focused) we’re seeing more MICE (buyers) in attendance and showing interest in Finland as a destination. (As such), in 2017 we will invite both leisure and MICE buyers.”

When asked if there was a specific campaign to court MICE groups, Mende said there was none at the moment as the bureau was “monitoring the situation and talking to individual incentive companies”, seeing that there were already “some MICE groups from Asia”.

While Finland is no stranger to MICE groups, the clientele has mostly been European. It was not until recently that companies began courting and handling Asian MICE groups.

Alexei Petrov, managing director of Levi-based Scandinavian Travel Group, told TTGmice: “We have been concentrating on the European markets, and only just started marketing to Asia. I was in Beijing in October 2015, and this is the second time I am meeting a lot of Asian buyers. But we’ve handled a lot of MICE groups from Europe, and we can offer the same experience, where the only difference is the addition of a Chinese-speaking guide. The Asian MICE market is one with a huge growth potential for us.”

Said Aurelie Martin, sales executive of Safartica, a full service safari house and DMC in Rovaniemi: “We’ve had one group of 100 pax from Citibank in Hong Kong. It was our first experience with Asian MICE.”

Seija Vesala, sales team manger, Rukan Salonki, added: “We are very strong in the domestic market but had only four Asian MICE groups. We are looking forward to more Asian groups in the future.”

Leisure travel, on the other hand, has been growing rapidly over the past few years.

Antti Karjalainen, director of sales, Scandi Hotels, added: “We have Asian groups, but these are mainly leisure. There are some incentives, and we see the MICE potential especially from China and Hong Kong. Overall, the Asian market is the fastest-growing market for Finland, with double-digit growth for 2016.”

Karjalainen believes that for Finland to succeed in its MICE quest, it must “tell clients what the opportunities and options are for MICE in Finland”.

One way is by highlighting unique and fresh itineraries, according to Martin. “We need to give clients proper information on what activities can be done in Finland. For example, we transferred the Hong Kong group to their hotel by reindeer, and they had dinner in a snow igloo. These are unusual and exotic activities for (Asian clients).”

While Martin reckons the Asian market “will be huge for Finland and Lapland”, she cautioned about the downsides of mass tourism.

She added: “While we want to welcome everybody, we need to handle them well and maintain quality, and not kill the reputation of the destination.”

Meanwhile, Helsinki attracted 275 international association meetings in 2015, which were attended by more than 35,200 people and generated 66.5 million euros (US$70.4 million) in tourism income for the capital city.

“Congress organisers are clearly interested in Helsinki, and there is a lot of demand for the coming years. We are already working on projects for congresses to be held in 2023,” commented Ines Antti-Poika, convention director, Helsinki Convention & Events Bureau.

Antti-Poika pointed to Helsinki’s reputation for security, high standards of education and technology, and unique tour offerings as other key selling points.

Upcoming international events include the European Academy of Allergy and Clinical Immunology in June 2017, and the annual congress of International Federation of Surveyors, FIG Working Week, in May/June 2017.

In 2015, Helsinki’s registered accommodation inventory was 17,074 rooms, 362 more than the previous year, according to statistics published by Visit Helsinki.

In October 2016, the Clarion Hotel Helsinki and the Clarion Hotel Helsinki Airport opened and added 425 and 258 rooms respectively to the capital region.

While no new conference centres are coming up at the moment, Clarion Hotel Helsinki offers 15 meeting rooms, while an old warehouse building adjacent to the hotel has been transformed into an event venue for 1,000 guests.

The Northern Lights is a big draw for incentive

groups arriving in Finland

4

The number of congress and exhibition venues in Helsinki. The largest is the Messukeskus Expo and Convention Centre (for 10,000 pax), while the smallest is the Scandic Marina Congress Center (700 pax)

80

The number of direct weekly flights to Finland from 17 Asian destinations

100

Finland will celebrate its centennial of the country’s declaration of independence on December 6, 2017

1,887

The average expenditure in euros, equivalent to US$2,094, of a single congress visitor to Helsinki

30,000

The number of people who attended international association meetings in Helsinki between May and August 2016

One of the best ways to introduce a destination and its culture is through the belly, and Restoran Rebung Dato Chef Ismail is just the place to charm international delegates.

Concept Celebrity chef Ismail Ahmad is famed for his delicious Malay cuisine, and he backs this restaurant located just opposite of Perdana Botanical Garden. He carefully plans the menu and monitors the food quality with an eagle eye.

There is a choice of buffet and a la carte for lunch and dinner, but I highly recommend the buffet as you get to sample more than 40 dishes for lunch and more than 50 for dinner. As these dishes are favourites from all over Malaysia, cooked using different styles and influenced by the different culture of each state, one gets to travel all around the country without ever leaving the restaurant.

MICE application There is an air-conditioned area for 180 diners, and two non-airconditioned areas, one of which is a veranda overlooking a herb and vegetable garden and the other at the back with a stage area where live music is offered at night. Four small private dining rooms of various sizes are available, seating 10 to 100 guests. These rooms have portable projectors and built-in screens.

Venue buy-out is possible and costs RM300,000 (US$71,327). Interior decorations and and seating arrangements can be customised for the event.

Event planners can also ask restaurant staff to introduce diners to the various dishes and their origins.

Restoran Rebung Dato Chef Ismail offers outdoor catering services.

Service Service is impeccable. Be sure to make reservations as the restaurant is busy for lunch.

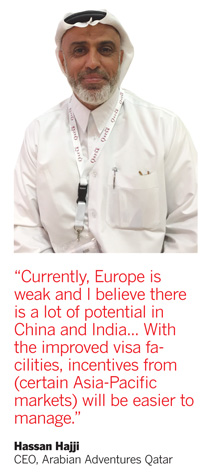

More programmes and mid-tier accommodation are surfacing in Qatar as the trade hones in on new and traditional MICE markets. By Caroline Boey

Qatar, host of the 2022 FIFA World Cup and the first country in the Middle East to clinch the event, is banking on MICE and events travel to fulfil the Qatar National Tourism Sector Strategy 2030 as the kingdom embarks on the diversification of its economy.

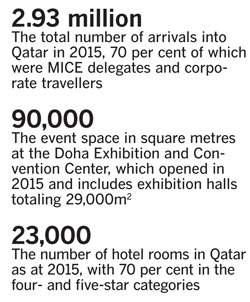

According to the Qatar Tourism Authority (QTA), MICE accounted for 70 per cent of the nearly three million visitors Qatar welcomed in 2015 and the number is expected to grow threefold to nine million in the next 15 years.

The opening of the new Doha Exhibition & Convention Center in 2015 along with the Qatar National Convention Centre are expected to attract a major increase in meetings, exhibitions and other events.

A senior spokesperson with QTA added that the destination’s tourism strategy is in place to secure long-term economic viability through an increase in hotel capacity to meet what’s required for the upcoming 2022 FIFA World Cup.

He said: “Now, 70 per cent of hotels are in the four- and five-star category. But there will also be a substantial increase in three-star and serviced residences opening in 2019 to meet the needs of the Gulf Cooperation Council (GCC) markets, which may also suit other markets,” he noted.

Qatar is investing an estimated US$45 billion on hotel and resort development until 2030 and the four- and five-star room boom kicked into high gear in 2015 with some 4,000 new keys added and more in the pipeline.

Another strategy the QTA is adopting is to market the culture and authenticity in the destination, which could enhance MICE experiences with a “sense of place”, added the spokesperson.

In Asia, QTA has been working on increasing the small base of MICE visitors from Singapore and Malaysia in the last two years and will begin to focus on China in 2017 to extend its reach beyond the traditional GCC countries and European markets like Germany, Austria, Switzerland, France and the UK.

The QTA spokesperson said: “We increased our B2B partnership in Singapore, Malaysia and Hong Kong over the last two years and there was a 14 per cent increase across the markets.”

And to tap China, Qatar has launched a visa-free scheme for Chinese travellers with up to four days in transit and will make available online visa applications in 2017 to leisure and MICE travellers.

DMC Arabian Adventures Qatar, established in 1987 ,

,

has been tapping the Asian market for almost a decade and CEO Hassan Hajji observed: “Currently, Europe is weak and I believe there is a lot of potential in China and India. For us, international MICE is still very small but with the improved visa facilities, incentives from Malaysia, Singapore, South Korea, Japan, Australia and New Zealand will be easier to manage.”

Other players interviewed expressed that Asia had not previously been a major focus, but is quickly gaining in importance.

Gulf Adventures, set up in 2000, has been handling small Asian incentives (25-30 pax) and larger corporate meeting groups from China and Singapore (60-65 pax).

Tare Helmy, director of sales, told TTGmice that business from Asia, comprising about 200 to 300 travellers a year, is quite a small part of its overall clientele, but the DMC has big plans for some of its promising markets.

“The outlook from Asia shows that China offers the biggest potential and we are planning to appoint a representative in Shanghai,” said Helmy.

He shared: “A unique productwe offer is an inland sea safari. Guests drive through the high sands of the desert just outside Doha on the way to a desert camp at the Inland Sea and enjoy a swim in the waters.”

Helmy added that the company has a campsite for 1,200 people to stage a gala dinner with falconry demonstration while live bands and overnight stays can also be arranged. Asian groups also have the option to play a round at the Doha Golf Club.

As well, The Ritz-Carlton Doha reopened in November 2016 after a total makeover and Bahaa Ghaith, cluster assistant director of sales, of the hotel and The Ritz-Carlton Sharq Village and Spa, said: “We don’t have MICE groups from Asia yet, but we have the space to accommodate Asian corporate meetings and events.

“There are many Japanese companies in Qatar and apart from them, we are also eyeing markets like India, Thailand, Singapore, Malaysia and Australia to prepare for the increased competition.”

![]() The Qatar Tourism Authority unveiled the Qatar Destination Brand in November last year at World Travel Market in London, marking the first time a brand to represent destination Qatar was created.

The Qatar Tourism Authority unveiled the Qatar Destination Brand in November last year at World Travel Market in London, marking the first time a brand to represent destination Qatar was created.

![]() The Shangri-La, Double Tree by Hilton, Pullman, Adagio, Dusit, and Mondrian were some of the brands which planted their flags in Qatar in 2015, followed by the Waldorf Astoria, Mandarin Oriental and M Gallery in 2016 and Le Méridien and JW Marriott among the properties scheduled for 2017.

The Shangri-La, Double Tree by Hilton, Pullman, Adagio, Dusit, and Mondrian were some of the brands which planted their flags in Qatar in 2015, followed by the Waldorf Astoria, Mandarin Oriental and M Gallery in 2016 and Le Méridien and JW Marriott among the properties scheduled for 2017.

![]() One of the biggest developments for Qatar, the Doha Metro mass transit system will feature four lines extending across more than 300km of track and incorporate nearly 100 stations. The first phase is scheduled to be up and running by 2019 with completion of the whole network earmarked for 2026.

One of the biggest developments for Qatar, the Doha Metro mass transit system will feature four lines extending across more than 300km of track and incorporate nearly 100 stations. The first phase is scheduled to be up and running by 2019 with completion of the whole network earmarked for 2026.

With a weak ringgit, affordable hotel rates and better hardware, the stars are aligned for Kuala Lumpur’s MICE sector to prosper. By S Puvaneswary

The main gateway into Malaysia, Kuala Lumpur is benefitting from a weak ringgit, affordable hotel rates and improved infrastructure which altogether are driving business events to the city, revealed inbound agents.

Inbound agent, Nanda Kumar, managing director of Hidden Asia Travel & Tours, had seen a 20 per cent increase in meetings and incentives from Indonesia during the first 10 months of 2016, up from 2015.

Kumar explained that “reasonable” rates at quality city hotels with updated hardware had helped.

“I can get agent rates of RM350 (US$78) to RM450 for a five-star international branded property in the city. Five-star rates here are similar to four-star options in Indonesia,” he said, adding that clients can also enjoy many new upscale properties and refurbished older ones that meet global standards.

Arokia Das, senior manager at Luxury Tours Malaysia, said his company witnessed strong growth in regional markets such as Indonesia and the Philippines, especially for meetings and incentives, catalysed by a weak ringgit and new products that expand pre/post-conference options.

“Kuala Lumpur City Hall and Kuala Lumpur Tourism Bureau has invested a lot in making the city more attractive to tourists, and this has helped us to promote the destination to business event organisers and to come up with creative itineraries,” Arokia said.

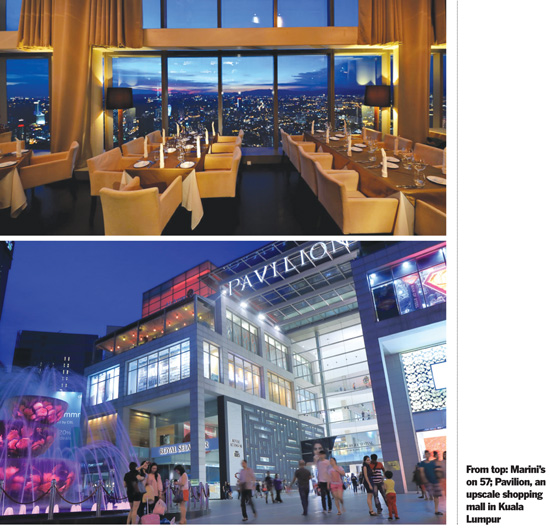

“For example, restaurants and bars at high elevations, such as Atmosphere 360, Marini’s on 57, Nobu Kuala Lumpur, SkyBar and Heli Lounge Bar, make excellent (venue)choices for events. Organisers are willing to pay for unique experiences and great views. These restaurants and bars are also very conveniently located in Kuala Lumpur City Centre and around Kuala Lumpur Convention Centre,” he said.

Getting around Kuala Lumpur City Centre has also gotten easier for event delegates looking to explore the city in their free time. Kuala Lumpur City Hall built covered walkways linking shopping malls in the Bukit Bintang area with its surrounds in late 2014. Shoppers can use a 4.5km sheltered elevated walkway that links Berjaya Times Square, Sungei Wang Plaza and Pavilion Kuala Lumpur.

Abdul Rahman Mohamed, general manager at Mayflower Holidays, told TTGmice: “We have seen increased demand for meetings and incentives from regional markets such as Thailand, Vietnam and Cambodia, and we think one of the reasons for choosing Kuala Lumpur is their increased buying power thanks to a weakening ringgit.

“Many organisers like to stay in the city centre because of the many shopping options available.”

China, a darling source market for many leisure and business events destinations, is also on the radar of Malaysia’s tourism industry and the country’s government has established an e-visa facility in March for Chinese passport holders to facilitate their arrival. This is a boon for Malaysia’s business event organisers, as visa processing duration has been greatly reduced from five working days to just one.

Through the e-visa, Chinese visitors can stay up to 30 days in Malaysia.

Abdul Rahman said: “This has made it hassle-free for Chinese event delegates to obtain a visa. Kuala Lumpur is always the preferred choice for the Chinese to hold their meetings and incentives because it is the main gateway and has infrastructure for large meetings with a few hundred to thousands of delegates. It also has tourist elements such as shopping, nightlife and nature-based activities like jungle treks and canopy walks.”

He added that sightseeing options outside of Kuala Lumpur, such as to Kuala Selangor, Royal Selangor Visitor Centre and Sunway Lagoon, can also be arranged easily.

![]() Scheduled for completion in 2018, Kuala Lumpur Convention Centre’s expansion will provide an additional 10,000m2 of flexible and multi-purpose space over three floors. The foyer areas on levels one and three will link directly to the existing facility. There will also be three levels of underground car parks with 1,500 spaces, two levels of retail and F&B outlets, a sky garden overlooking a park and a rooftop restaurant. After expansion, the Centre will offer 30,059m2 of space, making it ideal for larger international association meetings and concurrent events.

Scheduled for completion in 2018, Kuala Lumpur Convention Centre’s expansion will provide an additional 10,000m2 of flexible and multi-purpose space over three floors. The foyer areas on levels one and three will link directly to the existing facility. There will also be three levels of underground car parks with 1,500 spaces, two levels of retail and F&B outlets, a sky garden overlooking a park and a rooftop restaurant. After expansion, the Centre will offer 30,059m2 of space, making it ideal for larger international association meetings and concurrent events.

![]()

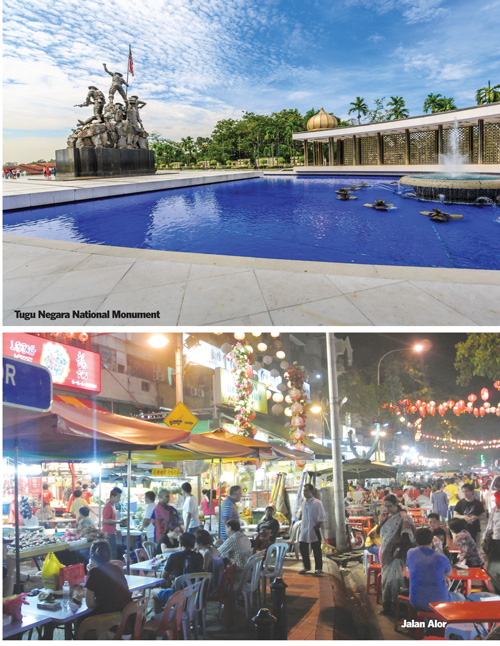

Taman Tugu, designed as a lush forest reserve with more than a thousand species of tropical trees, will emerge at the back of Tugu Negara National Monument. Costing RM650 million (US$155 million) to build, the attraction will have its phase one ready by 2018. There will be camp sites, jungle treks, lakes and a water park, as well as an outdoor venue for events. Walkways have been planned to connect it to Taman Perdana Botanical Gardens and other tourist attractions in the area, including the National Museum and KL Sentral.

![]() Famous for being a hive of delicious street food, Jalan Alor is up for an upgrade and its new face will be unveiled in 1Q2017. New landscaping and lighting works can be expected to elevate the dining experience. Jalan Alor is very accessible, with many four- and five-star hotels within close proximity.

Famous for being a hive of delicious street food, Jalan Alor is up for an upgrade and its new face will be unveiled in 1Q2017. New landscaping and lighting works can be expected to elevate the dining experience. Jalan Alor is very accessible, with many four- and five-star hotels within close proximity.

CWT’s Matt Brennan talks to Karen Yue about his role as vice president of hotel operations and why it is a critical function

Yours is a newly created position and for a division that is rather rare in a TMC. Why is it critical for CWT to have a Hotel Operations division and how will this benefit CWT’s clients and their travellers?

The landscape of business travel is changing and CWT is making bold investments in innovation and our people. Hotels are a key focus area for us and I believe there’s still a lot than can be done to improve the traveller experience in this space.

Having a dedicated Hotel Operations organisation will enable us to implement solutions faster and more systematically across the world.

CWT already has a tremendous amount of hotel content – nearly 500,000 properties around the world. The challenge is making this content available to all our clients across the globe. The Hotel Operations division will be responsible for streamlining implementation, and ensuring that the hotel content we offer our clients is available across all our booking channels, both offline and online, and across all markets.

This approach will help us provide a more consistent hotel booking experience for our clients. It will also enable us to provide better value for clients and their travellers by helping us contract the best rates and availability with hotels.

I am excited to be in a position to help CWT really focus on the dynamic hotel and accommodation needs for businesses and their travellers. In order to create a seamless and consistent experience for travellers, we will pursue a deeper understanding of the different travellers in the client’s organisation during an accelerated and specialised onboarding process. This way travellers are even more satisfied with their tailored experience, faster.

Does sharing economy accommodation suppliers sit within the care of your division? Airbnb struck a partnership deal with CWT in mid-2016. How do you balance them with your traditional hotel suppliers?

All of our accommodation supplier relationships are managed by our Hotel Supplier division.

We are in process of implementing our first pilot clients with Airbnb and this will help us understand the real appetite for these suppliers in the managed corporate travel space. A study published by CWT Solutions Group (*) indicated that just 2.5% of travellers whose travel policies allow Airbnb bookings have actually used it. We already know that the sharing economy is a key option in hotel pricing for markets in Asia-Pacific including Japan, Australia and New Zealand. Drivers include a lack of supply and prices up to 50% cheaper than a comparable hotel option.

On the other hand, traditional suppliers like hotels and serviced apartments offer a high level of service and consistency across their properties, which is difficult for sharing economy providers to match. Moreover, travellers that require assurances such as fire detection systems, deadbolt locks, safes and more, may not find these services in sharing economy property.

That said, some companies like Airbnb and Uber have launched offerings targeted specifically at business travellers that aim to address many of these concerns around safety, service and consistency.

Ultimately, the decision on whether to include services like Uber and Airbnb in a travel programme lies with the client. These services are a good fit for some travel programmes, but they may not be right for all. Whether or not the sharing economy is a good fit for any given company will depend on their company culture, their appetite for something new, and their risk management policies, among other things.

Corporate clients’ regard for sustainable meetings and events is growing, and in a recently published study on Chinese Meetings & Events Meetings & Events habits by CWT, 52.6% of respondents voted sustainable meetings and events as an important trend. How does this impact your work with hotel partners and matching them with this growing focus on green events?

When working with hotel suppliers, we can facilitate a request for a summary of their green initiatives to share with our clients. This reinforces the precedence that these are important to us and our clients.

Although 52.6% of respondents surveyed voted sustainable meetings and events as an important trend, this was actually the lowest ranking element. This is an indication that the meetings and events industry in China is in an early phase of its development, where consolidation of spend and suppliers, as well as adoption of technology, remain the top priorities.

For Meetings & Events clients, consolidation of meeting spend is at the top of the list. There is a stronger focus on knowing the suppliers you are working with, which in a lot of cases includes a screening process by a third party. Working with a reduced number of suppliers makes this process easier and more cost effective.

How do you foresee hotel consumption performing in the various global regions in 2017, with macroeconomic considerations in mind, and how do you expect hotel partners to respond in terms of corporate rates and offers?

We are seeing relatively low, inconsistent and in some cases fragile economic growth. Hotel rates globally will grow slowly, with the biggest impact in the Americas where rates are expected to increase by 4% (*). Mega hotel mergers are grabbing headlines, but their impact on prices likely won’t be felt until 2018. Hotel services such as room service, laundry and security remain important to corporate travellers. Traditional hotels, therefore, remain an attractive option for business travellers, despite the sharing economy options.

(*) 2017 Global Travel Price Outlook, July 2016

(**) The sharing economy: Here to stay. Now what?