Tailored communications the way to go

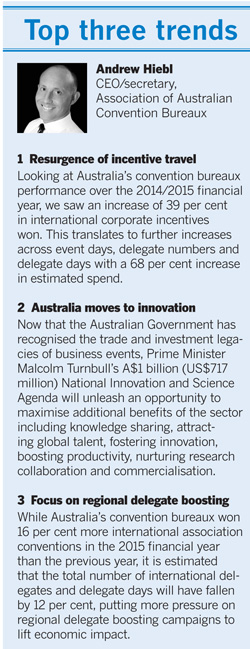

Australia delivered a solid performance in terms of business events in the 2014/2015 financial year, with approximately 174,000 international delegates visiting the country for the purpose of attending a convention or conference according to the June 2015 edition of the International Visitors Survey. This was a five per cent increase on the previous year, and accounted for three per cent of all international arrivals.

But the real victory was in delegate spend which reached A$612 million (US$440 million), 14 per cent up from the previous financial year and a 34 per cent increase from 2010/2011.

According to Penny Lion, general manager of business events, Tourism Australia’s strategy in 2016 will continue to focus on the markets and sectors that can deliver the greatest return on investment for Australia and the team will continue to deliver tailored marketing and communications that “reach the right customer at the right time”.

“We will continue to deliver our trade programme, bringing influential buyers and media from Greater China, North America, New Zealand and the UK together with Australian industry at offshore events such as IMEX Frankfurt and on bespoke educational visits that provide first hand experiences to our audience on why there’s nothing like Australia for business events,” she said.

Lion also said the team would continue to produce content, both written and filmed, to deliver news, information and Australia’s business events capability to potential clients.

In terms of business expectations in 2016, Lion said: “Direct selling companies in China continue to look for destinations that can inspire their teams, and they consider Australia unique as a place of inspiration.”

Sydney will host the 2016 Nu Skin Success Trip and the Amway China Leadership Seminar in 2017 for 10,000 delegates.

Lion said Australia had received more interest and enquiries from the North America market for incentive and association events, and that the New Zealand market will continue to be a key focus.

“We are also planning several new initiatives in the content space in the UK market to leverage interest levels and support industry.” – Rebecca Elliott

Bumpy ride ahead for MICE

The year 2015 was not a good one for Hong Kong’s business events sector, with only 1.1 million overnight MICE visitors recorded in the first nine months of the year, a 6.2 per cent drop year-on-year. Longhaul market traffic plunged 14.7 per cent while shorthaul arrivals fell 4.3 per cent. China, an important source market for Hong Kong’s tourism sector, put forth weaker numbers with a 3.1 per cent decrease.

The year ahead will continue to be a challenging one, opined Hong Kong Tourism Board’s executive director, Anthony Lau, who warned that the volatile macro environment will impact MICE and tourism. He said: “To rise to the challenges ahead, we must remain optimistic, nimble and entrepreneurial. We will continue our strategic focus on high-growth markets and industry sectors, including science, medical science, engineering, social science, technology, and commerce.

“Apart from participating in major MICE tradeshows, we’ll continue working with our trade partners to develop attractive offers that will increase the appeal of Hong Kong, so that it remains a top-of-mind destination for world-class events.”

The bureau will hold travel missions, seminars, workshops, roundtables and networking events in key markets in Asia, Europe and the US.

Swire Travel, general manager for business development – destination & event management, Edmund Tsang, believes that for Hong Kong to remain competitive in the long term, it needs to be marketed jointly with neighbouring Macau which is churning out new integrated resorts, more gaming facilities and upgraded ferry fleets.

East and West Travel, which specialises in shorthaul MICE, reported a 20 per cent decline in business last year. Manager Alan Tang believes that “2016 will be a critical year for MICE due to external factors such as the opening of Shanghai Disney Resort” which is expected to draw travellers’ attention away from Hong Kong.

“However, business will improve because of realistic and affordable hotel rates (in Hong Kong),” Tang opined.

To recover Indonesian numbers which fell 30 per cent in 2015, East and West Travel held a road show in the market in January where it presented special packages put together with local agents and Cathay Pacific Airways.

For Panda Hotel, 2015 was a year that “performed well beyond our expectation”.

However, in view of “the existing economic conditions”, the hotel’s director of meetings and conferences development, Virgie Choi, said HK$50 (US$6.40) have been shaved off the full-day meeting package price for 2016. Hosting a full-day meeting now costs HK$480+ – the same rate offered in 2013.

The hotel is also banking on its new meeting facility – the 533m2 Crystal meeting room which opened in December 2015 – to draw MICE interest in 2016, and will continue to engage overseas event planners in markets like Bangkok, Kuala Lumpur and Singapore. – Prudence Lui

National investments a booster

The business events market for India turned out a lacklustre performance in 2015 as major source markets like Europe continued to suffer an economic slowdown.

R K Mishra, managing director of Eastern Voyages, lamented that there was no growth out of European markets in 2015 and the company had failed to find new markets to help overcome the business slowdown.

“India’s tourism ministry is not spending on promotion and there is a need to create buzz about India as a destination,” Mishra urged.

However, with a stable government now in place and Prime Minister Narendra Modi’s string of international visits helping to establish India as a welcoming business destination, several MICE players are optimistic of a better year ahead.

Raj Rana, CEO, South Asia of Carlson Rezidor Hotel Group, said: “The Prime Minister’s state visits in 2015 to countries like Japan and China will positively impact business in 2016, as many activities tend to follow such visits and we believe they will benefit our hotels in the larger cities.”

Swadesh Kumar, managing director of Shikhar Travels India, sees growth potential in Asian markets in 2016. He said: “I expect 15 to 20 per cent growth from the Japanese market stemming from an expected surge in Japan’s investment into India. An example of which is Japan’s assistance in India’s first bullet train project.”

Several government initiatives have also been credited for renewed business confidence among inbound MICE players.

The government’s Make in India initiative, which encourages companies to manufacture in India, is expected to catalyse international business events growth in the destination.

The National Rural Internet and Technology Mission in emerging Indian Tier II and III regions is another business motivating factor, opined Prashant Narayan, COO and head, Leisure Travel Inbound Business, Thomas Cook India. He commented: “(This initiative) is a sharp move and it will (benefit) the under-leveraged inbound MICE segment.” – Rohit Kaul

Exhibitions, government meetings most robust

A dedicated MICE directorate may have ceased to exist within the Indonesian Ministry of Tourism but the country’s quest for international business events continues.

Esthy Reko Astuti, deputy minister for domestic tourism promotion, told TTGmice: “We will contine to support bidding for events, development of destinations and promotions.”

She expects the new Indonesia Convention and Exhibition Bureau, which is being formed, to take on the active role of developing the industry and promoting MICE in Indonesia.

Preliminary survey conducted by the Ministry of Tourism and Statistics Indonesia showed that MICE contributed nine per cent of domestic travel movements and about two per cent of international arrivals in 2014.

Indonesian MICE players say there are opportunities for growth in the country.

Wisnu Budi Sulaeman, CEO of Puntama Convex, said: “Government meetings in the country will keep MICE business going in 2016, thanks to the easing of government regulations on such meetings held outside state-owned premises. There are also a lot of associations in Indonesia which we can tap (for events).”

According to Wisnu, the opening of new upmarket hotels with large meeting venues in Bali and the establishment of offices in Indonesia by international exhibition organisers are signs of strong confidence in the market.

“The growing middle class in Indonesia has attracted them. What we need next is to create exhibitions that attract international buyers, such as spa products or automotive spare parts,” he added.

Hendra Noor Saleh, director of Dyandra Promosindo, one of Indonesia’s most prominent exhibition organiser with some 400 events a year, has urged government agencies to work together for a stronger MICE future.

He said: “The spirit of Indonesia Incorporated among government agencies is still missing. While the Ministry of Tourism has come up with policies to ease arrivals (like visa-free facilitation), other government agencies are not supporting it. For example, we wanted to bring in the Batman car for an exhibition but the custom duty we had to pay to import and re-export the vehicle was almost the same as the price of the car itself.” – Mimi Hudoyo

More cities in the limelight

Japan’s MICE sector has performed better in 2015 than in the previous year, for the same reasons that the nation’s tourism sector has shown such stellar growth, and there are expectations that trend will continue in 2016.

“Most foreign MICE events in Japan this year have been fruitful and we are particularly happy to be able to say that Japan as a whole has been successful in attracting more incentive tours from overseas,” said Katsuaki Suzuki, executive director of the Japan Convention Bureau, the division of the Japan National Tourism Organisation tasked with developing the MICE sector.

There are a number of contributing factors for this solid performance in 2015, Suzuki told TTGmice.

“There has been stronger promotion of Japan as a destination, favourable exchange rates against the yen and the relaxation of visa requirements, particularly for people from other Asian countries,” he said.

A second positive factor has been a return in interest among Chinese MICE buyers, he said, as political relationship between the two nations improve.

Bearing that observation out, a 2,000-strong incentive group travelled to Japan from Shanghai by cruise in early-2015, Suzuki pointed out.

The MICE Ambassador Programme, launched in December 2013, has also proven to be a good initiative, resulting in four international conferences in Japan.

The industry is aware, however, that other destinations in the region are also stepping up their MICE game and that Japan cannot afford to rest on its laureals.

“One of our plans is to strengthen the network between convention bureaus, such as through our Global MICE Cities project and other global associations in the MICE industry,” Suzuki said.

One facet of that will be creating new opportunities for convention bureau operators to build new business relationships with key buyers from overseas.

“We are also working hard to promote new destinations in Japan and to encourage MICE visitors to explore areas that are more off the beaten path, but which are now readily accessible and have a great deal of unique attractions,” he added.

One such region that has been opened up this year is Hokuriku, on the north coast of Honshu island. A bullet train linking Tokyo with Kanazawa opened in March 2015, leading to a sharp increase in the number of tourists to the region.

The industry does have some concerns, however, chief among them the boom in visitors to Japan causing a shortage of accommodation. For the MICE sector, when delegate numbers can soar into the thousands, this poses a particular and immediate problem.

Nevertheless, Suzuki is optimistic about the year ahead.

“We have very developed infrastructure and we believe that the growing number of inbound tourists to Japan will encourage MICE decision-makers to come here as well,” he said. – Julian Ryall

Top-level support drives MICE

Major MICE players like The Venetian Macao and Sands Cotai Central reported strong results from China, Japan, Hong Kong, India, Taiwan, Singapore, Australia and the US.

Director of sales for Venetian Macau, Stephanie Tanpure, expects a “promising” year in 2016 as clients are increasingly leaning towards accessible and unique destinations.

“Capitalising on our one-stop-shop offering of land and sea transfers from Hong Kong to Macau plays a large part in our success in growing business in 2016,” said Tanpure.

“We also believe that success lies with our properties that can provide the desired level of service, cultural authenticity, accessibility and, more importantly, security. While companies grow more interested in new and exotic locations, they remain committed to addressing these issues when finalising their venue of choice. In addition, we welcome The St Regis Macao which opened in December 2015 and The Parisian Macao which will open at the end of 2016,” she added.

According to Maria Helena de Senna Fernandes, director of the Macau Government Tourism Office (MGTO), Macau’s growing number of business events was a result of subvention programmes.

“We have been supporting incentive tourism by continually promoting the Travel Stimulation Program. From January to November 2015, we have supported 39 incentive events with 25,512 travellers through this programme,” she said, adding that new tourism facilities that are coming up over the next few years will further grow MICE business in the destination.

Taking destination promotion further is Macao Trade and Investment Promotion Institute (IPIM), which has since the start of 2016 rolled out a series of MICE support programmes such as the MICE Tradeshows Reward Program, previously run MGTO, and International Meeting and Trade Fair Support Programme, previously run by Macao Economic Services.

An IPIM spokesman said: “Through the pooling of resources into one entity, the industry will have a one-stop service for convention bidding and MICE support in Macau. IPIM will actively support local entities to bid for international events to be held in Macau, boosting the long-term development of Macau’s MICE industry.” – Prudence Lui

Air links catalyse MICE growth

Malaysia had improved her position in the ICCA Global Ranking 2014, jumping five places to 30th spot out of 115 countries. Malaysia also reaffirmed her credentials in the Asia-Pacific and Middle East region with a seventh placing, up two positions from 2013.

Zulkefli Sharif, CEO of the Malaysia Convention & Exhibition Bureau (MyCEB), said: “This is testament to Malaysia’s capability to successfully host large-scale, high-profile events and reinforces the country’s reputation as the preferred business events destination that is equipped with state-of-the-art facilities.”

MyCEB’s two key initiatives, Malaysia Like Never Before campaign and Malaysia Twin Deal X programme had received good responses since it was launched in early 2015. Up to 3Q2015, MyCEB had supported 147 events and received 339,137 delegates with an economic impact of US$258.1 million.

The Malaysian MICE trade is also optimistic about 2016. China which is Malaysia’s largest medium-haul market for meetings, incentives and leisure traffic is set to see further improvements this year, on the back of improved air links between China and Malaysia from 2H2015 as well as the government’s plans to introduce e-visa facility from January 2016.

Air China had resumed four weekly services between Beijing and Kuala Lumpur from October 25, 2015 complementing the daily services of Malaysia Airlines and AirAsia X. China Southern Airlines had also commenced thrice weekly services from Guangzhou to Kota Kinabalu from December 1, 2015.

Low-cost airlines are also developing new routes between the secondary cities in China and Malaysia with AirAsia recently starting new services between Kota Kinabalu and Wuhan from January 22 and four weekly flights from Guangzhou to Langkawi on January 24.

Winnie Ng, deputy general manager, Pearl Holiday, said: “Improved direct air accessibility is an advantage and makes it easier to pitch to Chinese MICE planners for secondary destinations beyond Kuala Lumpur.”

Mint Leong, managing director of Sunflower Holidays, said her client, Perfect China, a China-based health and wellness direct sales company, will bring 12,000 incentive delegates to Malaysia in March, with plans to visit Kuala Lumpur, Malacca and Penang. To date, this is the biggest confirmed incentive group for 2016. Coupled with confirmed bookings for smaller group ranging from 200 to 400 pax from March onwards, Leong believes 2016 will be a good year.

Local DMCs are also looking at a good year ahead for the Indian MICE market with the government’s plans to introduce e-visa facility by June to Indian travellers.

Air connectivity between Kuala Lumpur and Delhi will further improve from February 3 when AirAsia X resumes its direct flights from Kuala Lumpur to New Delhi with four weekly services. The new flights complements Malaysia Airlines daily services and Malindo Air’s 11 weekly flights on the same route.

Arokia Das, senior manager at Luxury Tours Malaysia, said the increased flight options would allow him to bid for bigger incentive groups.

“In 2016, we plan to further tap the northern (Indian) region for incentive business.” – S Puvaneswary

More fun for MICE in the works

The Philippines’ persistence in pushing for MICE is paying off as it is expected to have hosted more business meetings and conferences in 2015 than ever before.

Much of that increase came from major international events, foremost the Asia Pacific Economic Cooperation (APEC) meetings and Summit and others like Madrid Fusion Manila and the 17th Asia Pacific Retailers Convention and Exhibition.

Tourism secretary Ramon Jimenez Jr said the hosting of APEC, from December 2014 to November 2015, brought in about 22,000 foreign delegates for meetings held in eight host venues around the country while the APEC Summit in November brought 8,800 foreign delegates.

APEC 2015 “has showcased the country’s ability to set new standards for organising conferences and meetings,” Jimenez said, alluding to the growing number of convention centres, sophisticated meeting facilities, and hotels that were built and continue to be constructed in metro Manila and other areas.

The new MICE brand launched last year, Fun Works, is also giving MICE a boost. “The push really is for the whole world to know that the Philippines can capture international meetings. We encourage each Philippine region to build their own efforts in developing MICE and organise MICE-related activities,” said tourism assistant secretary Art Boncato.

That the private sector is collaborating with the government to put the Philippines on the MICE world map also augurs well for meetings and exhibitions this year and in the future, said Agnes Pacis, vice president sales and marketing, SMX Convention Centre.

“We’re optimistic. We’re showing growth in our numbers in overall events,” said Pacis, adding that MICE “is not so roller coaster” anymore the past months.

But Shan David, president of Corporate International Travel and Tours, echoed the view of many in the industry that two of the challenges of selling MICE is the lack of infrastructure facilities and insufficient air connectivity.

Even Boracay, highly popular for MICE, “has limited flights” and some destinations lacking in infrastructure are not ready for MICE, said David.

Others, like Hannah Yulo, director of sales and marketing, Paradise Garden Boracay Resort and Convention Center, are exploring new MICE markets and opportunities.

Leveraging on Paradise Garden being the only halal-certified resort in the Visayas, Yulo said she will focus this year on the Muslim market. After attending the Arabian Travel Mart in Dubai and meeting with fam groups from Bangladesh and Kuwait last year, she will go on a trip to Turkey and be involved with a fam group from Oman and Iran this year. – Rosa Ocampo

Investments in collaboration

THE first half of 2015 saw a plunge in the business travel and MICE (BTMICE) visitor numbers to Singapore, as well as a respective dip in related tourism receipts, according to the latest set of statistics from the Singapore Tourism Board (STB).

According to STB, a year-on-year decline of 16 per cent was observed for BTMICE arrivals, and per capita spending went down by nine per cent in 1Q2015. The downward trend continued into the second quarter, showing an eight per cent year-on-year dip in BTMICE arrivals and a 16 per cent drop in spending.

Overall tourism performance for the Lion City was dolorous too, with total visitor numbers down three per cent year-on-year to 7.3 million, and tourism receipts tumbling 12 per cent over the same period to S$10.5 billion (US$7.4 billion).

Chew Tiong Heng, executive director of Business Tourism Development, STB, said: “Macroeconomic factors have had a strong impact on Singapore, in particular economic uncertainties in some of our top markets for business travel and events, and the strength of the Singapore currency.”

While Judy Lum, group vice president for sales and marketing with Singapore’s Tour East Group, agreed that business for 1H2015 was “significantly down compared to 2014”, she said the second quarter had “picked up with a vengeance”, and seemed to be catching up especially from Europe.

Janet Tan-Collis, managing director of East West Planners Singapore, is equally optimistic, predicting “a busier 2016 ahead”.

Her confidence stems from Singapore’s “offering of unique and modern venues”.

“We have spaces like the Waterfront Promenade and Esplanade which are very popular. Singapore is always coming up with nice venues which are attractive to clients,” she said.

To boost this sector, STB has increased its BTMICE marketing investment globally to generate even greater awareness of Singapore as an attractive MICE destination.

Chew said: “The next six months, for instance, will see us collaborating with major media partners like CNN and The Economist to distinguish Singapore as a premier MICE hub anchored on thought leadership and business opportunities.

“To encourage more travellers to combine their business trips with leisure, we are also expanding partnerships with the travel trade, industry associations and various media owners to share destination lifestyle content and highlights with visitors, as well as provide flights, hotels and other deals targeted at business visitors from Asia-Pacific.”

“Moving forward, the pipeline for BTMICE events remains strong and will remain a significant and steady contributor to tourism,” he added.

According to Chew, Singapore’s line-up of events in 2016 includes large-scale association conventions like SpineWeek 2016, debut events such as EdTechXAsia and Asian Robotics Week, and healthcare products firm Unicity International’s first Global Convention in Singapore, which is tipped to attract some 25,000 people.

A darling of trade exchanges

THE business events industry in Taiwan celebrated a record revenue of US$1.23 billion in 2014, an impressive 21 per cent year-on-year growth from 2013, with 544 business events held.

Latest Meet Taiwan data found that nearly 190,000 international travellers visited Taiwan in 2014 to attend business events, with the bulk from Japan, South Korea, Malaysia, Singapore, Thailand and Australia. The growth is attributed to leading trade events such as COMPUTEX, Taipei International Cycle Show and the Taiwan International Boat Show.

Taiwan also emerged as the fourth top Asian destination in ICCA’s 2014 ranking of destinations by the number of international meetings hosted. It held a record total of 145 international meetings.

Walter Yeh, executive vice president of Taiwan External Trade Development Council (TAITRA), said: “The new record we set in terms of the number of international meetings organised in 2014 is a result of our determination and efforts.”

Ming Shui Yeh, TAITRA deputy secretary-general, said: “(The growth) was also a result of new convention and exhibition facilities in the northern Taipei suburb of Nangang and the southern industrial area of Kaohsiung. There are more (events) planned for centrally located Taichung.”

While 2015 MICE data has yet to be published, Yeh said the mayor of Kaohsiung city expects an increase in business events and conferences last year and has forecasted US$6.4 billion in revenue.

Kaohsiung Exhibition Center which opened its doors in 2014 and the TWTC Nangang Exhibition Hall 2 in Taipei which will be completed in June 2016 are expected to create further new opportunities for Taiwan in the Asian MICE industry.

TW MICE Event & DMC’s sales director, Stacy Yang, said: “Taiwan’s hotel sector is thriving, buoyed by the island’s transformation into an up-and-coming destination for Asian travellers. The number of visitors from China, Japan, South Korea, and Malaysia all rose by double-digit percentages last year, and this sustained tourism boom is changing the face of Taiwan’s hotel sector.

“Top global hospitality brands, which ignored Taiwan for years as they ramped up expansion in China and South-east Asia, are now giving the island a second look. The change is most visible in Taipei’s five-star segment, which is critical for attracting business travellers.”

Taiwan’s MICE sector has also been enjoying strong government backing. TAITRA had invested US$5.3 million in the Meet Taiwan project while the Ministry of Economic Affairs had allocated NT$230 million (US$6.9 million) to “accelerate the growth of talent, facilities, research expertise, and marketing support in 2015” to better the future of Taiwan’s business events sector.

Thomas Tsou, secretary general, Taiwan Convention & Exhibition Association, expects growth to continue into 2016, spurred particularly by a reshuffling of government that will improve cross-strait relationships and trade between Taiwan and China. – Paige Lee Pei Qi

Banking on world connections

Thailand Convention and Exhibition Bureau (TCEB) has set a modest five per cent growth target for the year ahead, aiming towards 1,060,000 international business travellers who will generate 92 billion baht (US$2.5 billion) for the Kingdom.

This compares to the 1,036,300 business events visitors and approximately 106.78 billion baht in revenue recorded for the 2015 fiscal year running from October 2014 to September 2015. For the 2014 fiscal year ending September 2014, Thailand welcomed 919,164 business events visitors and generated 80,800 million baht in revenue.

To ensure MICE performance improves after a turbulent 2014 that was rocked by political unrest, the bureau has invested in a series of destination promotion campaigns which will continue into 2016.

TCEB’s president Nopparat Maythaveekulchai said: “For 2016, we will promote Thailand with the new campaign, Thailand Connect Our Heart, Your World.”

The campaign highlights three key pillars of Thailand’s MICE industry: Destinations of Thailand which spotlights the country’s diverse destinations; Business in Thailand which emphasises Thailand’s location and its ability to help businesses seize opportunities around the globe; and People of Thailand which celebrates its people’s excellent and passionate service.

“The campaign will stress for business planners that Thailand is a unique destination at the heart of the South-east Asian pro-business bloc and is a thriving hub that offers seamless service from the heart and with an unforgettable smile,” Nopparat said.

TCEB will also focus on courting the high quality market to drive sustainable growth for the local MICE sector, and pay attention to the exhibitions sector, which is seen as a vital platform to enable local industries to expand trade and investments. To this end, TCEB has bid for and won the hosting rights to the UFI Open Seminar in Asia 2016 which will take place in Chiang Mai on February 25-26.

A TCEB press statement explained that hosting the event will strengthen the capability of local exhibition professionals and underline Chiang Mai as a gateway to Greater Mekong Subregion market.

Meanwhile, trade players the magazine spoke to are generally optimistic about 2016. Kris Srisatin, founder and managing director of Stream Events Asia, expects to see a broader mix of clients coming from Europe, the US and Australia.

Brian Connelly, general manager of the Angsana Laguna Phuket which had recently upgraded its ballroom in part to better cater to the MICE clientele, believes that “the coming year is looking more positive”. – Michael Mackey

The power and reach of the Chinese dragon

This year may be the year that China becomes the world’s largest business travel market after considering its recent rapid expansion, writes GBTA’s Joseph Bates

For years now, GBTA has been forecasting the impending, and seemingly inevitable, move for China to overtake the US as the world’s largest business travel market. Now that we have flipped our calendars to another new year however, and given the spending growth rates for each country, it appears 2016 will indeed be the year when this becomes reality.

China’s business travel market represents roughly 20 per cent of global business travel spending, up from 5.1 per cent in 2000. Despite recent economic turmoil, China business travel spending is projected to grow at 10.7 per cent in 2016, with business travel spending forecasted to increase by more than 60 per cent from 2014 to 2019 reaching US$420 billion.

In 2015, the GBTA Foundation looked beyond overall business travel spend and conducted the first-ever assessment of China’s MICE market.

GBTA estimates a total of US$110 billion was spent by Chinese business travellers attending meetings and events in 2014 in China, and we expect this market will continue to grow at a rapid pace as China’s economy expands. Nearly one-third (29 per cent) of Chinese business travellers expect the number of MICE meetings they will attend to increase over the next year.

Business travel for MICE activity comprises 42 per cent of total domestic business travel volume in China and 45 per cent of total business travel spending. Shanghai (27 per cent) and Beijing (25 per cent) hosted the majority of MICE trips in China over the last 12 months, followed by Guangzhou (24 per cent), Hong Kong (11 per cent) and Macau (six per cent).

Given that three-quarters of all meetings spend in the region is spread across just three countries, the industry has a lot of potential for growth, which presents a large opportunity for travel suppliers.

What do these trips look like? In the past 12 months, 86 per cent of business travellers have taken a trip for MICE purposes in China and each business traveller spends an average of US$1,100 per trip. Chinese MICE trips last 2.9 days on average with the majority of trips (59 per cent) lasting between two and four days. Most business travellers (64 per cent) reach their MICE destinations by air while 18 per cent travel by train and 14 per cent by car. MICE meetings are typically held at conferences and convention centres (38 per cent) or hotels (33 per cent).

Still, MICE business travel tends to be more discretionary than individual business travel. While a proportion of MICE activity is focused directly on sales, there is also a large emphasis on networking, education and training. This is a hallmark characteristic of a developing economy and training and education are vital to the long-term growth of Chinese businesses and the country’s economy in general.

GBTA expects MICE activity in China will only continue to grow for the foreseeable future.

A firm hold despite uncertainties

SITE’s Rajeev Kohli is fixed on the optimistic horizon of the incentive travel industry in a tumultuous world climate

As we begin 2016, we stop and ponder on all that happened in the past year and wonder what the year ahead holds for us. The incentive travel industry has always been one that is easily affected by the going-ons of the world. From uncertain economies and natural calamities to terrorism and political instabilities, the world saw much happen over the past year, affecting the way people travel.

As we begin 2016, we stop and ponder on all that happened in the past year and wonder what the year ahead holds for us. The incentive travel industry has always been one that is easily affected by the going-ons of the world. From uncertain economies and natural calamities to terrorism and political instabilities, the world saw much happen over the past year, affecting the way people travel.

Despite that, our industry has held strong. The 2015 SITE Index Benchmark Survey has thrown up some very interesting and encouraging indicators for 2016, showing positive trends for our industry.

Budgets are up – Overall, the study found a net increase in incentive travel budgets over the past year, a trend that should continue for the next 12 months at least.

While budgets are increasing a bit, nearly three quarters of incentive buyers are managing costs through a variety of approaches, the most common being planning shorter programmes (34 per cent), having fewer inclusions (29 per cent), and having fewer expensive destinations (29 per cent). At the same time, nearly seven out of 10 sellers (69 per cent) of incentive travel services are attempting to add value for their participants through more innovative event design.

World affairs – Despite data showing that incentive travel participation and spend are both increasing, the net impact of national and world events seems to be largely negative. Interestingly though, the state of the economy and cost of airline tickets were noted to have a far stronger negative impact than acts of terrorism. In some ways, it seems buyers and suppliers alike have accepted the paradigm shift in the world safety scenario.

Work, along with play – A growing aspect of incentive travel programmes that has become the norm is including a meeting component as part of the overall experience. According to the study, the portion of buyers who say that a meeting component is “always” involved in incentive travel programmes (42 per cent) is significantly higher than what many sellers recognise (19 per cent), while 84 per cent of incentive travel buyers at least “occasionally” include a meeting component in their events.

Do good – It is increasingly becoming the norm to incorporate a corporate social responsibility (CSR) component, with approximately seven in 10 incentive programmes including at least one CSR activity. Among participants in those programmes, 12 per cent place an emphasis on CSR.

It might be easy to assume that CSR activities are geared toward younger participants (e.g. millennials), but in reality, only about one in three programmes gear their CSR activities towards younger participants. The vast majority of respondents say they target everyone equally.

Faith and belief is the new ROI – Interestingly, while nearly everyone believes their incentive programmes are effective, only 28 per cent actually formally track the ROI of their programmes. Programmes are commonly accepted as being effective for driving successful performance, whether or not there is hard data to support that premise. In many cases, there is no requirement to formally assess a programme’s effectiveness, and often the success of a programme is assumed to reflect in the overall success of the organisation.

The bar is rising – Another finding of the study is that the incentive travel industry in all likelihood is going to become even more competitive.

Among those who sell incentive travel services to the industry, seven in 10 are currently developing newer and more creative ways to add value for their customers. With the creative standard becoming even higher, sellers of incentive travel services cannot afford to remain complacent about creating value through innovative offerings. If they do, they are very likely to quickly fall behind the competition.

Transforming the Asian exhibition space

In a connected world that relies heavily on technology, UFI’s Mark Cochrane predicts that the exhibition industry will evolve as new partnerships emerge

The exhibition industry has remained remarkably unchanged for a century or more. Even throughout the first dotcom boom 15 years ago, the global exhibition industry continued to grow and expand. The story in Asia has been similar. Face-to-face events expanded year after year – even during the dark days of the global financial crisis.

According to UFI’s latest research, net space sold at trade fairs in Asia jumped 6.8 per cent in 2014 reaching 18.6 million square metres, compared to 17.4 million square metres in 2013. More impressive, over the past five years (2014 vs 2010) net space sold in the region is up over 20 per cent – rising from 15.5 million square metres to 18.6 million square metres.

That is a remarkable and enviable success story, but it is now clear the exhibition industry will change more in the next decade than it did in the last century. The forces of change are primarily tech-driven. In fact, the opportunity for online platforms to move into exhibitions has been clear for more than 10 years.

In 2003, Hong Kong-based Global Sources, a B2B online sourcing platform, entered the exhibition space with little to no event organising experience. Today, the company has built a US$80 million exhibition business by leveraging on both its database of buyers and suppliers as well as its digital marketing capabilities.

Then in December 2015, a bigger tremor rumbled through the Asian exhibition industry. Alibaba.com and UBM Asia announced that they would begin to cooperate in 2016, effectively linking the world’s largest digital marketplace operator with one of the largest commercial exhibition organisers in Asia.

At this stage, the details of the partnership are unclear, but the potential opportunities are transformative. Alibaba reports that its online platform has 350 million active users and its mobile platform has an average of 290 million monthly users. Together, its various platforms posted a gross merchandise volume (the value of goods traded on Alibaba’s platforms) of over US$390 billion in 2014.

UBM organises more than 400 business events annually. It is an industry leader in key markets including China, India and the US. In Asia, UBM organises 230 events each year and has offices in 24 cities across the region.

As a first, relatively straightforward step, the partnership could allow UBM to market its portfolio of events to Alibaba’s database of millions of businesses – opening up a whole new world of potential exhibitors and visitors.

Alibaba could also pull invaluable insight and analysis from the millions of searches that run through its platform to guide UBM to better cover the hot product categories or even launch new events to address emerging buying trends in a particular industry or geography.

In addition to leveraging databases and business intelligence, there is also the potential for onsite matchmaking services and of course, further down the road, the promise of facilitating transactions.

While transactions may still be ways off, but my hope for 2016 is that the Asian exhibition industry is indeed poised to enter an exciting era of change.