Sharing economy travel providers have come up with business travel tools but why are companies slow to bite? Caroline Boey finds out

While acceptance of sharing  economy travel providers is growing among corporates, most travel managers are still saying no to putting their travellers in Airbnb accommodation citing duty of care issues.

economy travel providers is growing among corporates, most travel managers are still saying no to putting their travellers in Airbnb accommodation citing duty of care issues.

Unlike a hotel, which comes with strict safety and security codes, a private home may not. Protecting the privacy of the traveller – for example being filmed on CCTVs installed by the homeowner – and nobody to turn to in an emergency were some of the reasons companies cited for not travelling down this road.

On the other hand, transportation services such as Grab/Lyft and Uber are facing more green than red traffic signals, but usage still depends on the destination and whether or not there are legal constraints, the managers pointed out.

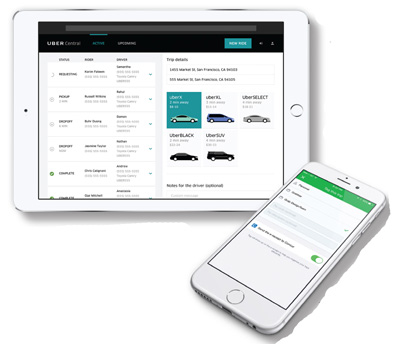

Peter Koh, Asia strategic sourcing manager – travel and professional services, Corning Singapore Holdings, told TTGmice: “We have yet to implement the use of sharing economy providers in our travel policy but one of them has been identified in the pipeline because it can send booking data to our travel security agent International SOS. But even then, we require our corporate security team’s approval, and have to educate our travellers on how to use the app.

“For Airbnb, it will be cumbersome for our travellers to invest time to find the right property for themselves, unlike a hotel which is easier to identify.”

There are exceptions to a hardline Airbnb stand and a Bangkok-based travel manager in a global manufacturing company said it would reimburse the traveller if prior approval to stay in Airbnb accommodation was given.

“It’s still rare and we are trying to limit the use. But pressure is mounting from travellers who have used Airbnb for leisure. It makes sense to allow it where there is a shortage of rooms especially during peak travel periods. While I don’t foresee (adoption) soon, we have to look into it. Like the LCCs, never say never!”

On the transport side, the Shanghai-based travel manager of a US technology company said the uptake for Grab/Lyft in the US has been very positive. “For now we are not using other sharing economy suppliers mainly due to security concerns. That and better visibility of cost savings are needed for us to consider including them in our travel programme.”

Describing the sharing economy as a “grey area”, another Shanghai-based travel manager said he and his boss had differing opinions. “I want to say yes to ground transport but he is unsure. We have not formally approved the use of sharing economy services in our global corporate travel programme but questions from travellers on whether or not they can use them have been increasing. The main obstacles are the uncertainty surrounding risk and legal issues.

“This is likely the easier one to deal with as these services have matured and can be an alternative to public transportation. Ride sharing is also an attractive aspect of the service due to sustainability and cost reasons especially with travellers from the same company going to the same destination.

“Lodging is trickier as (it requires us to move) away from suppliers with a brand name and level of service to uphold. The challenge to audit locations for safety and security in the many hotels we use today is huge. With homestays, it will be impossible to manage. There is also the challenge of capturing these bookings and managing risk.”

An IT travel manager in New Delhi added the main obstacle is still the “managed versus unmanaged debate”. “In today’s world when terrorist attacks are occurring more (often), duty of care as a focus area is very high and is (more important than cost savings).”

However, technology advancements may start to break down some barriers.

The announcement in July that BCD Travel is now working with Airbnb for Business to provide corporate travel clients with rich data in a new security and risk management tool that can track the location and trip patterns of business travellers who book Airbnb listings, may offer a breakthrough.

US-based Autodesk finally took the Airbnb plunge at the end of March after two years of watching and studying developments. With a millennial workforce of 30 to 40 per cent familiar with the sharing economy, and engineering teams with members ranging between 25 and 55 years old, Autodesk’s travellers fit the profile to be Airbnb poster children.

But it was not an easy journey to add the option into its travel policy, according to Adriana Nainggolan, travel programme manager, Autodesk Asia-Pacific. “We faced challenges with the legal and procurement departments. To implement it, we had to develop a training programme on how to use the Airbnb for Business portal, receive assistance from International SOS and ensure accommodation hosts are covered by insurance.”

In two months however, Nainggolan said Autodesk registered a six-figure US dollar cost saving in five cities – San Francisco, Singapore, Mexico City, London and Montreal – based on the “variance for the cost differential taken from the lowest rate of the day and the Airbnb rate”.

And after learning about the Autodesk experience, a travel manager in the oil and gas industry said he was “closely monitoring” sharing economy accommodation suppliers and other developments. “We have not considered Airbnb because of duty of care challenges, but we will listen to what our travellers have to say. However, we still need to be able to control out-of-policy exceptions.”