What will the new year bring for Asia-Pacific’s business event players? How will Asian markets approach business event plans? What key trends will impact business travel and events? TTGmice reporters get you the answers

Destination outlook

Most destinations in Asia-Pacific are upbeat about inbound business events this year, although different challenges are keeping players on their toes

CHINA

China’s inbound business events players are upbeat about 2017, saying China’s One Belt, One Road initiative is spurring new business ventures and driving demand.

Other factors such as China’s easing of visa requirements, launch of new international flights and increased air capacity to existing key routes are other reasons for the bullish outlook.

Joy Liao, sales director, Inbound and MICE Center, Century Holiday International Travel Group in China, said: “Although competition is intensifying, we are expecting (more) event attendees and to set a new record in 2017.”

Liao named India as a source market that will shine in 2017 and expects stronger demand for technical visits. Domestic business will remain strong too, with most demand coming out of Shanghai.

Julien Delerue, founder and general manager of online procurement platform 1000meetings, is optimistic too, saying 2017 is “a year of recovery, having faced weakness from the US and Europe – which either cancelled or postponed events in China – in 2016”.

He believes that China’s 2017 business events performance will depend on 2016 financial results. “The instability we are seeing is making it harder to read the market, which was not the case a

few years ago. Companies are more cautious than ever and are under increasing pressure to be more compliant in procuring goods and services. I see customers demanding more transparency and the rise in the use of technology to control spend and manage events.”

Destination Asia (China), Kaci McAllister, deputy general manager, who projected two good years in 2017 and 2018, told TTGmice that her company has been seeing strong leads from Australia, the UK and the US, and that “incentive business from the US seems to be coming back”.

However, McAllister cautioned that “if global economic health weakens (further), incentives and large corporate meetings (will) be cut”.

She noted: “Longhaul corporate and incentive travel from English-speaking markets tend to decline sharply in years when the global economy is not doing well.”

Less enthused about the new year is Nicole Wang, director of resource procurement, CTS MICE Service, who said the continued negative reports on China’s air pollution were denting business. She forecasted a flat year forward.

Singapore-based Ik Chin Travel Service, which organises incentives for Singapore and Indonesian groups using Singapore as a hub, saw business to Xiamen, Zhuhai and Zhongshan, slide about 20 per cent in 2016. Nancy Tan, managing director of the agency, said: “The number of incentives to China are being cut or postponed and it is hard to figure out how 2017 will be. We will have to wait and see what airline support we will be getting.” – Caroline Boey

HONG KONG

Hong Kong’s established reputation as an efficient destination for hosting world-class conventions and exhibitions has inspired business confidence among the city’s business events players.

Hong Kong Tourism Board (HKTB), MICE and cruise, general manager, Kenneth Wong, said: “Hong Kong has been (attracting) world-class conventions and exhibitions as well as professionals from various industries for knowledge exchange, especially in the medical, financial and technology sectors. Riding on the strong momentum, a series of high-profile medical conventions will be staged in the city, reflecting Hong Kong’s role as the ideal hub for hosting similar important events in the region.”

Wong has predicted “another exciting year for Hong Kong“ in 2017, and revealed HKTB’s plans to upgrade its Hong Kong Rewards! programme to “help delegates get the most out of their visit and attract more (business events) to Hong Kong”.

He added: “We also look forward to the opening of various new venues and products that cater for different event purposes, such as Kerry Hotel in 1Q2017.”

Grand Hyatt Hong Kong, director of sales & marketing, Cecilia Lo, expects 2017 to be a year of stability with some growth opportunity.

“We’ve noticed inbound demand (stabilising) over the last 12 months, with fewer peaks which meant minor downward rate adjustments. This has made the city more affordable for travellers,” she said.

Hong Kong may also see a rise in association meetings this year, according to International Conference Consultants, director, Katerina Tam. She said China’s One Belt, One Road initiative as well as the 20thanniversary of Hong Kong’s handover to China as a Special Administrative Region could inspire more association meetings to be held in the city.

The trade believes meetings and conventions will remain the stronger sectors in the business events industry, given the city’s strategic location, sophisticated infrastructure and experienced workforce. Leveraging these strengths, Meetings and Exhibitions Hong Kong, part of HKTB, has been reaching out to meeting and convention planners in new and longhaul markets. Its efforts have drawn strong enquiries, but space availability in Hong Kong remains a challenge.

Monica Lee-Müller, managing director of Hong Kong Convention and Exhibition Centre (Management), told TTGmice 2017 will be another great year for the venue, as the majority of its exhibitions are repeats. New shows will debut at the Centre too, such as Cloud Expo Asia on May 24 and 25.

What Hong Kong needs to watch for are attrition of event attendance as corporate travel budgets tighten in reaction to the global economic situation and other macro factors, Lee-Müller warned. – Prudence Lui

INDIA

Indian PCOs, hoteliers and convention centres expect 2017 to be an eventful year for inbound business, with the Indian economy looking up and interest from overseas companies to do business in the country growing.

Some industry stakeholders expect that meetings and conferences will lead the growth for inbound business events.

K B Kachru, chairman emeritus and principal advisor for Carlson Rezidor Hotel Group, South Asia, said: “The meeting sector will continue to grow for India. We will also see more international congresses moving into India. The country continues to develop and grow its second- and third-tier cities – a good complement as meeting planners are exploring new destinations to host their events to deliver fresh experiences.”

For Novotel Hyderabad Convention Centre & Hyderabad International Convention Centre, events in the IT, medical sciences, aerosciences, defence, agriculture, financial and engineering industries are expected to thrive.

The venue’s director of sales and marketing, Gorav Arora, added that North America would be his strongest source market, with 20% to 25% of business hailing from the region.

Industry veterans believe that support from the government and high-level industry associations has helped to boost India’s appeal in the business events scene.

“The government sector is putting a lot of business events into the country and this will continue to surge owing to the Made-in-India initiatives,” opined Amit Saroj, director, Attitude Events.

“Efforts of industry bodies like SITE India and India Convention Promotion Bureau (ICPB) are paying off too,” said Rajeev Kohli, joint managing director of Creative Travel, whose company is seeing good demand for incentives and meetings from markets including the US and Western Europe. – Rohit Kaul

INDONESIA

An air of optimism is surrounding Indonesian business event players this year, even as the global economic situation remains uncertain and government meetings are few.

Susilowani Daud, PACTO Convex president director, told TTGmice that bookings and leads gained by her company are painting a positive picture of the future. Among PACTO Convex’s forward bookings is a harbour-related conference which will be attended by some 1,500 national and international delegates as well as a number of medical and government events with 500 to 1,000 delegates expected.

However, she is “cautiously optimistic” and added that “as long as there is no travel warning (against Indonesia), everything will be all right”.

Ketut Jaman, president director of Melali MICE Bali, reports a positive outlook too. Leads from incentives are coming in for Melali MICE Bali, and he expects Bali to welcome even more international incentive gatherings this year. But with the bulk of the national budget being channelled into infrastructure development across the country, meetings spend in the government sector will likely shrink along with the number of meetings held locally, opined Jaman.

He has also predicted that association meetings will be affected by weaker participation, as delegates who often have to pay for their own attendance lose spending power in the face of global economic woes. On the bright side, meeting producers in Europe and the US will turn their delegate boosting efforts to the healthier Asia-Pacific region, resulting in a spike in seminars and product launches in countries here, including Indonesia.

For Yasinta Hartawan, general manager operations at Bali Nusa Dua Convention Centre, corporate meetings will be dominated by domestic clients, and business will rise 10 per cent on 2016.

Wisnu Budi Sulaeman, CEO, Puntama Convex, urged his peers in Indonesia to take advantage of the hundreds of trade associations in the country that have international affiliations, to court more association meetings. – Mimi Hudoyo

JAPAN

Business event arrivals in Japan has grown alongside leisure arrivals in 2016, prompting the country’s inbound business event players to predict yet another successful year in 2017.

Business event arrivals in Japan has grown alongside leisure arrivals in 2016, prompting the country’s inbound business event players to predict yet another successful year in 2017.

According to Etsuko Kawasaki, executive director of the Japan Convention Bureau (JCB), Japan welcomed more than 20 million leisure visitors before the end of October 2016. “It is the biggest figure ever, and the business event industry is following that trend,” she said.

A number of major events taking place in Japan will likely give business event

arrivals a boost, she added, such as the World Congress of Neurology, scheduled to take place over six days in September in Kyoto and with 7,000 delegates expected.

“We have not set a 2017 target for business event visitors,” Kawasaki said. “Our aim is to remain in first place in the Asia-Pacific region and to win more major events. In particular, we want to promote incentive programmes in Japan, especially from other Asian markets.”

Key markets at present are South Korea and Taiwan, although JCB is aiming to score more groups from China and South-east Asia in the coming year.

Longhaul markets are more of a challenge, Kawasaki admitted, purely because of the distance involved, but the bureau believes that increasing numbers of holidaymakers will spread the word about Japan as an ideal destination for business events.

Okinawa is keen to raise its profile on the world stage for business events, according to Sayaka Mori, spokesperson for the Okinawa Convention Centre. “We are very positive about 2017, in part because the prefecture this year surpassed Hawaii in terms of the total number of tourist arrivals. We welcomed over nine million visitors,” she told TTGmice.

“We also have a strong pipeline of new hotels with event facilities coming up, including in central Naha, the north of the main island and on some of the outlying islands,” she said.

Hotel operators are also optimistic as Japan heads into 2017, with Masafumi Katou spokesperson for the Grand Prince Hotel Takanawa, saying the strong demand has led to a shortage of large venues for up to 2,000 people in Tokyo. – Julian Ryall

MACAU

Macau’s business events industry has performed well in 2017, according to Macao Trade and Investment Promotion Institute (IPIM) which is aiming to secure even more ICCA-approved association meetings this year.

Already in the destination’s bag for 2017 are a number of large-scale, high-profile meetings such as the 13th China Expo Forum for International Co-operation, held for the first time in Macau from January 12 to 14; the International Cartilage Repair Society World Congress in April; and the 39th Asia Pacific Dental Congress in May.

Sands China, vice president, sales and destination marketing, Ruth Boston, expects a good year ahead, noting that business on the books looks much stronger this year compared to 2016. She said: “Both incentives and meetings are estimated to be strong; all signs are pointing that way so far. Macau is still a preferred destination due to the variety of product offerings.”

For Sands China, key source markets in North Asia have continued to post growth, while additional growth in the US and Australia are expected.

Also positive about the new year is Timothy Tan, director of sales for Sheraton Grand Macao Hotel, Cotai Central and The St. Regis Macao, Cotai Central, who is encouraged by a stronger business performance in 2016.

Tan said: “As long as Asia-Pacific remains stable, inbound business events will continue to grow. IT and direct sales companies will continue to shine in 2017, as they need to hold their customer events every year and require locations like ours that can cater for large numbers of delegates all under one roof. The banking and finance sectors are still soft but the rest of the sectors are doing well.”

MCI Macau Office, director of business development and events, Olinto Oliveira, believes the market will begin to rebound in 2017 after subpar performances in 2015 and 2016.

Oliveira identified India as a source market that will deliver strong results for Macau’s business events industry in 2017.

“While European markets won’t contribute to massive business numbers, they should grow a little as Macau gains global awareness and more clients turn to it as a fresh destination for well-travelled delegates,” he said.

Oliveira expects Asia-Pacific’s economic health to be on the upswing this year, which will bode well for business events.

“A healthy economy tends to mean more spending on events, particularly incentives and other major public events where ROI may be more about brand presence or rewarding high performers,” he said. – Prudence Lui

MALAYSIA

Despite the uncertainties in global and regional markets, Malaysian business event players are optimistic about their core markets in 2017, based on forward bookings and enquiries received end of 2016.

They claimed the weakened ringgit, which had depreciated by seven per cent within the span of a month in November 2016 after the US presidential election results were announced, has helped to secure new businesses.

Arokia Das, senior manager at Luxury Tours Malaysia, told TTGmice in December that confirmed incentive groups from India and Indonesia for 1Q2017 was at least 20 per cent better than the corresponding period in 2016. He said many organisers had locked in the rates early as they thought the ringgit was at its lowest.

Nanda Kumar, managing director at Hidden Asia Travel & Tours, said there was an 18 per cent rise in confirmed forward bookings from India, Sri Lanka and Indonesia for 1Q2017, and credited the wins to the destination’s affordability. He added: “There are also a lot of sightseeing options that we can recommend to our clients who like to combine Kuala Lumpur with Penang or Langkawi.”

Scoring well with markets beyond Asia is Saini Vermeulen, executive director, Within Earth Holidays, whose company is making inroads in Eastern Europe with confirmed bookings for 2Q2017. “There is less competition from Malaysian DMCs in this market. The corporate clients we get like culture and adventure, which is why we like to combine Kuala Lumpur with East Malaysia. They usually choose four- or five-star properties and like to combine at least two regional countries,” he explained. – S Puvaneswary

The Philippines

Business events in the Philippines are expected to see yet another good year in 2017, buoyed by the guaranteed hosting of the third Madrid Fusion Manila, ASEAN Summit, International Food Exhibition Philippines, UNWTO’s 6th International Conference on Tourism Statistics, and many more.

All sector of business events – meetings, incentives, conventions and exhibitions – are showing strength, especially regional meetings and incentives which are the ones “that bring the bodies,” said Maricon Ebron, deputy COO for marketing and promotions sector, International Promotions Department of the Tourism Promotions Board.

Vince S Reyes, managing director, ED IMC Firm Corp., pointed out that most of the inbound business events are from the region.

While interest in the Philippines as a destination already exists and the number of events is expected to climb on the back of the ASEAN integration, Reyes noted that security and infrastructure concerns will continue to influence clients’ decisions.

Illustrating the sensitivity of security concerns to business event clients, an event organiser told TTGmice that a French group cancelled its event last August due to the spate of extrajudicial killings that has become a part of Philippine president Rodrigo Duterte’s war against illegal drugs. Another planner said a Canadian group also cancelled its event after the Davao bombings last September.

To address the country’s insufficient infrastructure, the government beginning this year will undertake the biggest infrastructure programme in Philippine history by allotting 800 billion pesos (US$16 billion) in partnership with the private sector.

Also to have a positive bearing on the business events industry is the recent initiative of the Department of Tourism and the Philippine Association of Convention/Exhibition Organizers and Suppliers, Inc. (PACEOS) to develop a roadmap to raise the industry’s competitiveness. Tourism undersecretary for development planning Benito Bengzon Jr said the roadmap will have three parts: industry issues and challenges; short, medium and long-term strategies to meet these challenges; and recommendations on strengthening the linkages among industry stakeholders. – Rosa Ocampo

SINGAPORE

An uncertain economy ahead is making business event specialists in Singapore cautious about business in the coming year.

Judy Lum, general manager, Diethelm Travel Singapore, warned that corporate spending would be “more careful” and “big ticket items like holding overseas events” would be trimmed.

“My concerns lie especially with markets with weaker currencies like the UK, and (those undergoing political changes like) the US,” Lum added.

Likewise Linda Low, manager of strategic partnership and product marketing, Pacific World Singapore, said she is “cautiously optimistic” about 2017 in view of the economic uncertainties around the world.

According to Low, the number of business leads have stagnated, inbound business events from Australia is “still slow”, and the demand from the US and France has seen no changes.

Low also noted rising competition for business events around the region, which does not bode well for “expensive” Singapore.

While acknowledging the impending economic headwinds, Aloysius Arlando, CEO of SingEx Holdings, said: “The business events industry is a robust one and has proven its worth in many similar economic challenges before, so we are confident of our resilience in riding out the current wave.”

Arlando shared that one of their strategies to combat the gloomy outlook is to calibrate their event outcomes with cautious sentiments by industry players and their cash flow management. Hence he said SingEx has adopted a flexible approach both in terms of financial payment schemes as well as in taking on a proactive partnership role with event organisers to reduce costs and increase value.

He said: “The overall pipeline for business events for our venue remains strong in 2017, fuelled in part by bright spots especially in the IT corporate meetings and medical segments.”

To tackle rising competition, Melissa Ow, deputy chief executive, Singapore Tourism Board, said work is being done to increase the mindshare of Singapore as a top business events destination.

Ow said: “We are running different campaigns to highlight various aspects of Singapore to industry stakeholders and business travellers. For example, we recently collaborated with CNN, Bloomberg, and other online platforms to establish Singapore as a premier business events hub anchored on thought leadership and business opportunities, and will continue to explore further collaborations to inspire business travellers to extend their stay or return to Singapore for leisure visits.” – Paige Lee Pei Qi

SOUTH KOREA

There are concerns among South Korean business event stakeholders over political disputes between Seoul and Beijing impacting inbound Chinese groups, but the industry says it is working hard to build on its recent successes.

In 2015, for example, the UIA ranked South Korea first in Asia and second in the world for the number of international congress it hosted. And in 2016, 21,000 overseas participants took part in the Rotary International Seoul Convention.

“We expect our main incentive market, China, to decline in 2017 due to political issues,” said Kim Kap-soo, executive director, MICE Bureau of the Korea Tourism Organisation (KTO). “But KTO is planning a variety of projects in China and we will continue to carry out marketing initiatives in distant source markets such as India, Russia and the US.”

China has long been South Korea’s largest source of incentive travellers, followed today by Vietnam and Thailand.

To attract more markets, the MICE Bureau will enhance its Conventions and Incentives Support Scheme and introduce a MICE Ambassadors programme. It also sees the 2018 Pyeongchang Winter Olympics as a good opportunity to promote “exciting new business event destinations in South Korea,” Kim said.

Andrew Moore, director of business development at the Conrad Seoul, is upbeat about the sector in the New Year.

“Early indicators see us ahead of booking pace and enquiry volume for 1Q2017, and we expect this trend to continue,” he said. “All signs show that Seoul is clearly getting it right – and its star is only continuing to rise.”

Thanks to Seoul’s reputation as the “Silicon Valley of the East,” telecommunications will continue to be the dominant sector, alongside education, finance and healthcare.

A recent slowdown in healthcare-related events is only expected to be a blip because “it’s a soaring sector which enormous interest,” Moore said.

Avril Lee, sales manager for the Lotte Hotel in Seoul, expects a “small-to-medium increase” in meetings in 2017. – Julian Ryall

THAILAND

The Thailand Convention and Exhibition Bureau (TCEB) has projected continued growth for the kingdom’s business events industry, with targets of 1.11 million business visitors and US$2.9 billion in revenues set for 2017. These are up from 2016’s 1.06 million business visitors and US$2.6 billion in revenue.

A TCEB spokesperson told TTGmice that the bureau is “confident” of achieving these targets, as several flagship events have already been confirmed in Thailand, including the 10th International Petroleum Technology Conference (2,500 delegates); the 10th International Convention of Asia Scholars (2,000 delegates); VIV Asia 2017 (30,000 delegates); Bangkok Entertainment Week 2017 (700,000 participants).

Local business events specialists who spoke to TTGmice are echoing the optimism too.

Impact Exhibition Management Co, general manager, Loy Joon How, said his venue in Bangkok will welcome several new international shows in 2017, in addition to regular annual events, and he has a positive outlook for the new year. The new wins include INTERMAT, a construction machinery exhibition; SIMA, an agricultural machinery show; and Beyond Beauty, ASEAN’s biggest international beauty exhibition.

Vitanart Vathanakul, executive director, Royal Cliff Hotels Group and Pattaya Exhibition and Convention Hall (PEACH), also shared that “many groups (are) repeating their events with us in 2017” and that the number of new enquiries will make the new year a “promising” one. Massive incentive groups from Infinitus (China), Nu Skin, Meltwater and Manulife have been confirmed, for instance.

Vitanart credited the positive performance of his properties to the Thai government’s support. He explained: “The government’s plan to develop infrastructure including the U-tapao-Pattaya-Rayong International Airport and improve road accessibility will greatly help Pattaya’s events business. From our side, the management of Royal Cliff Hotels Group and PEACH have invested heavily in improving our venues and services.” Business going into IMPACT Muang Thong Thani will also get a boost when its second hotel, an ibis brand, opens in March. Loy said the new hotel will raise the venue’s total room inventory to over 900.

Pornthip Hirunkare, managing director-Thailand, Destination Asia, pointed out a few developments in Thailand that will stand the country in good stead when it competes for international business events – new conference and event spaces within ICONSIAM on the banks of the Chao Phraya River in Bangkok, and Phuket’s new and improved airport. – Karen Yue

VIETNAM

Vietnam will shift its focus towards Asia as business events from longhaul markets are predicted to soften in 2017.

With economic growth expected to be sluggish throughout 2017, coupled with uncertainty following Brexit and the US elections, the country’s tourism industry is bracing itself for a slowdown from Europe and the US.

Gregg Allan, vice president of operations (ASEAN) at Pan Pacific Hotels Group (PPHG), which operates Pan Pacific Hanoi and Parkroyal Saigon, said: “Corporates are more cautious about spending on large-scale events. Coupled with an uncertain global economic climate, inbound traffic from these markets is likely to be slightly less robust compared to Asia.”

Noting Asia’s potential, Vietnam’s Ministry of Culture, Sports and Tourism is putting huge efforts into helping the business events industry grow. Vietnam National Administration of Tourism (VNAT), for instance, is intensifying its international promotion of the country’s diversity, gourmet and rich cultural heritage. Business events and cruise tourism are key focuses to attract more high-yield visitors.

In a recent attempt to stimulate the market, Vietnamese and Singaporean travel agencies came together at a VNAT-hosted roadshow. The aim was to promote Vietnam as a business event destination while learning from Singapore, a regional leader in the sphere.

The opening of Japan’s first tourism office in Hanoi in November is expected to push business between the two countries. PPHG has already noted growth from Japan as well as South Korea, encouraged by large foreign direct investment inflows.

The implementation of a tourism cooperation plan between the ministry and the Russian Federal Agency for Tourism is also expected to see a continued rise in demand from Russia.

Jeff Redl, managing director of Diethelm Travel Vietnam, said: “Due to our specific tourism products for the Russian market – sea-island leisure and sea-island leisure combined with culture tourism – Russia is still identified as an important source market.” – Marissa Carruthers

Trends to watch

Industry veterans tell Karen Yue what will shape the various business event and corporate travel sectors in 2017

Greeley Koch, executive director, Association of Corporate Travel Executives

Political US trade policy might reduce the country’s international footprint, leading China to increase trade between the Asia region and Europe, creating more business travel within the region.

Political US trade policy might reduce the country’s international footprint, leading China to increase trade between the Asia region and Europe, creating more business travel within the region.

Social With social media sites like Facebook, WeChat and Instagram boosting the image of travel, more and more millennials are spending their free time and money on extending business trips for personal pleasure, a trend known as ‘bleisure’.

Personal Business travellers are putting a much higher priority on finding a work/life balance on the road. The result will be a much stronger emphasis on the quality of sleep, maintaining a proper diet, and supporting an exercise regimen. This will have definite implications for the hospitality sector throughout Asia.

Rajeev Kohli, president, Society for Incentive Travel Excellence

Growing recognition of the impact of incentive travel Ninety-nine per cent of buyers (who participated in the the 2017 SITE Index) believe that incentive travel is effective in achieving important business objectives. Sixty per cent report they plan to increase the number of people eligible for incentive travel awards and nearly half have increased budgets.

Growing recognition of the impact of incentive travel Ninety-nine per cent of buyers (who participated in the the 2017 SITE Index) believe that incentive travel is effective in achieving important business objectives. Sixty per cent report they plan to increase the number of people eligible for incentive travel awards and nearly half have increased budgets.

Impact of world economy A majority of both buyers and sellers (in the incentive travel space) say that the world economy has the potential to negatively impact their travel programmes in 2017. Creating value becomes paramount amid economic concerns.

Greater need to prove value Measuring the effectiveness of incentive programmes is limited with less than 25 per cent of buyers “always” or “almost always” tracking return on investment. Lack of measurement could make these programmes vulnerable during tough economic times.

The scourge of terrorism Almost 80 per cent of buyers see a negative impact of terrorism on their ability to plan and implement incentive travel programmes, and one in four believe tightening of border security will also have an impact.

Mark Cochrane, regional manager, UFI – The Global Association of the Exhibition Industry

Changing venue landscape New venue capacity continues to shape key markets. In Shanghai, after opening in 2015, National Exhibition and Convention Center continues to impact China’s largest exhibition market. New or expanded venues in Jakarta, Bangkok, and Kuala Lumpur are on the horizon and are expected to unlock growth in those key markets in 2017 and beyond.

Changing venue landscape New venue capacity continues to shape key markets. In Shanghai, after opening in 2015, National Exhibition and Convention Center continues to impact China’s largest exhibition market. New or expanded venues in Jakarta, Bangkok, and Kuala Lumpur are on the horizon and are expected to unlock growth in those key markets in 2017 and beyond.

Strain on the exhibition labour pool More than a decade of rapid growth has made the Asian exhibition industry the envy of the rest of the world, but there is a downside. Organisers, venues and service providers are struggling to find and retain talented, experienced staff. Look for increased investment in training – especially for mid-level managers.

Emphasis on health and safety Rapid growth and strains on the labour pool have also increasingly put an emphasis on risk mitigation for international organisers operating in Asia. Increased attention on (occupational) health and safety best practices will be an important trend extending well beyond 2017.

Asian appetites

With business events in Asia projected to be driven mostly by neighbouring source markets, TTGmice finds out how Asian buyers are intending to spend their event budgets this year

CAMBODIA

Cambodian firms tend to prefer domestic destinations such as Siem Reap (Angkor Wat pictured); Picture by Banana Republic images/shutterstock

Cambodia’s appetite for outbound business events has yet to reach its potential, claim industry experts.

Such travels are few but is expected to pick up in the future as the Cambodian economy swells.

Danine Samith, Exo Travel’s event department manager, said: “Local companies still don’t have the culture of spending much money on overseas events. However, they already have a culture for staff parties and outings, so I believe they will make the move to overseas events soon.”

She added the few requests for overseas events had mainly come from local branches of international companies.

Despite many Cambodian companies not looking abroad, domestic corporate travel is proving popular with large businesses organising annual staff parties and teambuilding events spanning one to three days.

The coast of Sihanoukville remains the hottest choice, along with Kep, Kampot and Siem Reap, said Kimhean Pich, CEO and founder of Discover the Mekong.

Those travelling overseas tend to stay close to home, said Samith, adding Thailand is a popular destination – especially Pattaya – because of its easy access. Vietnamese island Phu Quoc, which sits off the Cambodian coast, is another hit with Cambodian companies.

“They rarely go farther than this,” said Samith. “Budget is an issue as well as visas if it’s not within South-east Asia.”

Yulia Khouri, CEO of Innov8 Events, said: “As the Cambodian economy expands and new companies are opening their doors in the country, events become an excellent way of marketing new products and bringing brand awareness to the public.”

Cambodia’s liberal investment policy that fosters foreign investment and encourages the creation of local branches is expected to stimulate interest in business events. The arrival of large European banks, such as BRED, and the opening of the new Coca Cola plant are examples of the prospective market.

Samith said: “With the economy increasing by an average of seven per cent, we can bet in the near future outbound business events will become an important segment.” – Marissa Carruthers

CHINA

Spain (Madrid pictured) is gaining the favour of Chinese meeting and incentive groups

China’s outbound business event demand is expected to grow by more than 20 per cent, group size will also expand, and Australia, New Zealand and the US will continue to be the hot choices in 2017.

According to Nicole Wang, director of resource procurement, CTS MICE Service, the number of outbound business event groups with delegates in the thousands and mega-size events with 10,000 participants are expected to increase.

“More Chinese companies in the automotive and direct selling industries are turning to business events, particularly incentives, to drive business performance. As long as there are direct flights and safety is not an issue, Chinese groups will venture overseas. European destinations are OK, but not Turkey. Clients are also picking Japan, Africa and emerging Asian destinations. What appeals to clients are natural scenery, good beaches and culture,” Wang noted.

Rubén Casas, senior director of sales & marketing Asia Pacific, Meliá Hotels International, said industries driving outbound event demand are pharmaceuticals, finance and insurance, fast consuming products/direct sales; IT, chemicals and Chinese national companies – in descending order.

“Research conducted following IBTM China 2016 confirmed that 88 per cent of buyers expressed interest in Europe, including Spain, France, Germany, Austria and the UK,” Casas added.

Robert Tan, executive director, sales and marketing, Lac Hong Voyages, Vietnam, also expects to see continued growth in Chinese incentives, which had a strong showing from Guangdong.

“We saw 20 per cent growth in 2016 and expect the same in 2017,” he said.

Lac Hong Voyages is organising new charters, possibly with Shenzhen Airlines and another Chinese carrier, to facilitate the arrival of more Chinese incentive groups in 2017.

Demand for nearby destinations like Hong Kong and Macau among Chinese clients has unfortunately been waning the past two years, according to Julien Delerue, founder and general manager of procurement platform, 1000meetings.

“Their drop in popularity is political and in the case of Taiwan, it is hard to get a visa. Around the region, safety and favourable currency exchange make Thailand, South Korea and Japan choice picks. However, Thailand is not perceived to be as safe as before but it is still more affordable to go to Phuket than to Sanya,” said Delerue.

With the strong US dollar and an exchange rate of about RMB6.84, Kaci McAllister, deputy general manager, Destination Asia (China), revealed some Chinese clients are looking to hold most of their 2017 meetings and incentives at home. – Caroline Boey

HONG KONG

Global economic uncertainty continues to affect Hong Kong companies considering overseas business events.

Nan Hwa (Express) Travel Service, executive director, Jason Shum, expects outbound business in the new year to be weaker due to tighter travel and event budgets but added that certain industries like direct sales, insurance and pharmaceutical will continue to hold events even in tough times.

Shum said Australia, Dubai and Singapore are still in demand among Hong Kong clients.

Rosanna Leung, head of business development and MICE with Towa Tours, also saw bright spots in Hong Kong’s insurance industry. She said: “(They) provide the largest traffic overseas. Popular picks for longhaul regions are Australia and Eastern Europe, while Osaka and Taipei are hot for shorthaul options.”

When asked what could adversely impact Hong Kong client’s plans for overseas business events, Leung pointed to currency fluctuation, terrorist incidents, political instability and health scares.

– Prudence Lui

Dubai maintains firm demand among Hong Kong business event planners Picture by Luciano Mortula/shutterstock

INDIA

This year will likely see domestic destinations emerging as the darling of Indian corporate clients planning their events, according to Indian event organisers who credited a booming national economy and cost effectiveness of organising local events for the trend.

“With new inventory being added in the hospitality market, cost of holding a business event in India has become a much more affordable option than (heading to) other Asian countries,” said Manpreet Singh, vice president and head, MICE, FCM Travel Solutions India.

According to Karan Anand, head of relationships, Cox & Kings, the business events industry in India is growing at a rate of 15 to 20 per cent annually, of which a large part hails from the domestic market.

“The reason for this growth is the expansion of the Indian economy which is growing at over 7.5 per cent per annum. This fuels opportunities for companies that incentivise their employees and dealers (towards better performance). The gradual improvement in domestic infrastructure has also allowed companies to focus on Indian destinations for their business events,” said Anand.

Meera Charnalia, senior vice president, MICE, Thomas Cook India, believes that international movements will pace up from 2Q2017. “Banking, insurance and Indian consumer (product) companies will lead that demand,” she opined.

Singh also identified fast moving consumer goods and agriculture industries as strong drivers of Indian business events, as they “are aggressively providing incentive trips overseas to dealers from the rural and non-metro areas of the country”.

While popular business event destinations like Singapore, Thailand and Malaysia in Asia and Switzerland, London and Paris farther afield will remain favourites among Indian corporate clients, Anand said there is a “growing interest in exploring newer and off-the-beaten-track destinations (like) Spain, Finland, Istanbul, Greece, Egypt, Jordan and Turkey.”

– Rohit Kaul

INDONESIA

A growing national economy and the continuous need for companies to motivate their staff and business partners with incentive trips are tipping Indonesian outbound business event players towards a positive outlook for 2017.

Rama Tirtawisata, group managing director, Panorama Sentrawisata, said the government had reported an economic growth of 5.1 per cent, one of the highest in the world in 2016. That, along with a tax amnesty, have given local businesses more confidence in the new year.

“These companies are in turn motivating their staff to achieve more. With that comes more incentive programmes,” Rama added.

Vidya Hermanto, managing director of Orange Incentive House, told TTGmice that enquiries and forward bookings are painting visions of a good year, and expects corporate event budgets to return to 2015 levels. One of the big wins for his company this year is a gala dinner for 500 people at the American Museum of Natural History.

Golden Rama has also welcomed 2017 on a positive note with groups heading to Japan and Turkey in January. Assistant manager-incentives, Victor Martawidjaja, reckons European destinations will continue to earn the favour of Indonesian companies, based on enquiries so far.

Putu Ayu Aristyadewi, vice president corporate communications, Smailing Tour, said the business event segment is his company’s most stable performer because companies will always need to send staff out for meetings and reward staff and partners with trips.

Putu said Japan is popular in Asia now, while Indonesian companies will continue to aspire to take groups and events to Europe.

Smailing Tour expects business to grow by 15 per cent this year. – Mimi Hudoyo

JAPAN

The most worrying clouds on the horizon for Japan’s outbound business event industry are the same as those in 2016, said Japanese event agencies.

Economic fluctuations with both short- and longer-term implications, political uncertainties, particularly given the terrorist attacks that have shaken European destinations in the past year, and growing tensions in parts of Asia are casting a shadow over Japanese outbound business events performance.

Atsushi Seki, general manager of the meeting and conventions division of JTB Communication Design, expects “overall outbound business will be slightly smaller than in 2016”.

Seki described the situation in Europe and the US as “worrying”, and said Japanese incentive groups as a result are preferring to stay closer to home, with destinations such as Taiwan and Hong Kong gaining in popularity due to their close proximity. Slightly farther afield, resort destinations such as Bali are seeing firm demand.

“Companies with a big budget often go to Hawaii or cities in Europe because business event demand mimics what is happening in the leisure travel sector,” said Seki. “Europe is still weak because of the risk of terrorism.”

Other operators say they are seeing an increase in incentive tours that combine an element of promotional work, particularly among industrial companies, such as those in the automotive sector. – Julian Ryall

MALAYSIA

Malaysian business event players are bracing for a challenging year in 2017, a result of a weak ringgit that has made outbound travels a pricey undertaking.

Citing an example of how the ringgit’s decline had affected outbound incentive travel, Abdul Rahman Mohamed, general manager at Mayflower Holidays, said: “In April 2014, the ringgit was trading at RM3.15 against the US dollar. We had incentive clients from the insurance and oil and gas sectors travelling to Europe, as they could get a hotel, accommodation and airfare package for around RM7,000 (US$1563) to RM8500 per person.

“When (the exchange rate depreciated) to RM3.75, the cost of travel became higher and organisers started to look at Japan and South Korea. In 2016, we saw incentive demand for longhaul destinations dropping by more than 40 per cent.”

Another outbound player, Adam Kamal, CEO of Olympik Holidays, said: “In 2016, we saw corporate companies from all sectors cutting costs and revising travel budgets. We think this trend will continue into 2017.”

As a result, domestic destinations will benefit from corporate incentive traffic. Olympik Holidays has been receiving RFPs for incentive trips to Sabah, Sarawak, Johor, Langkawi and Penang.

“Bearing in mind that Malaysians are also seasoned domestic travellers, we offer new hotels and new attractions to inspire excitement,” he said, adding that numerous travel promotions emerging from the South-east Asia region’s Visit ASEAN@50 campaign this year will encourage even more requests for regional programmes.

Syed Razif Al-Yahya, group managing director of Sutra Group of Companies, expects the cost-cutting fever that plagued companies and government agencies in 2016 will continue into 2017. Overseas meetings will involve fewer staff and a lower class of seat class will be preferred on flights. – S Puvaneswary

MYANMAR

More Myanmar companies are looking overseas for business events, and China is proving to be a hit, said VIVO Myanmar DMC CEO, Ye Tun Oo, citing the strong trade deals between the two countries as the catalyst.

Other overseas destinations that appeal to Myanmar companies include South Korea, Japan, those in South-east Asia and Europe.

Thida Myint, director of sales at EXO Myanmar, said domestically the coast remains popular with companies wanting to host training, teambuilding or incentive trips. “The beach is always a popular destination for Myanmar companies,” she said.

Ngapali and Myeik are expected to be hot domestic destinations in 2017, especially as facilities and infrastructure develops in the two areas.

Ye adds that interest in domestic events currently remains low, with attendance at exhibitions and events on home grounds minimal.

However, as the country continues to develop at a rapid pace and more companies invest in Myanmar, interest in business events is predicted to pick up. “I expect this to become significantly bigger in the next three years at least,” said Ye.

Until February 2015, tour operators in Myanmar were unable to offer overseas trips. The Ministry of Hotels and Tourism passed legislation that allowed travel companies to apply for licenses to offer trips abroad for Myanmar nationals.

Luke Stark, general manager at ITS Myanmar, said: “The effects of this are being seen and will continue to grow into 2017 as the market becomes more sophisticated.”

He predicts that as more international companies land in the country, the business event market will grow. “

Myanmar’s natural resource exploration and gem mining sectors are currently driving business events domestically and internationally, while demand from telecommunications and fast moving consumer goods logistic sectors has expanded significantly over the last two years.

– Marissa Carruthers

THE PHILIPPINES

Filipinos’ appetite for outbound business events is expected to remain undiminished this year although travelling abroad has become much more expensive with the US dollar gaining continuously against the Philippine peso.

Marites C Pastorfide, assistant general manager/sales manager of Wayfair Tours said outbound events, especially incentive trips, will continue because companies – especially those dealing in multi-level marketing, investment, insurance, pharmaceuticals and law – need to keep rewarding and incentivising their champions.

Brisk sales as a result of the growing Philippine economy also means more reward trips for top sellers.

Pastorfide said Asian destinations will continue to flourish – they’re preferred over domestic destinations and are more affordable than longhaul ones.

For companies opting for domestic destinations however, Boracay, Palawan and Cebu combined with Bohol are still top choices. Companies would choose luxury accommodations such as Discovery Shores in Boracay and Pangulasian Island in Palawan.

Pastorfide said the most popular Asian destinations are Hong Kong, Bangkok, Seoul and across Japan, all of which are actively and heavily promoted in the Philippines.

Simon Ang, managing director-operations, Celebrate Life TLC, said Asian luxury cruises are also an option. These floating resorts include Aqua Mekong cruise down the Mekong River with shore excursions in different towns of Vietnam as well as Aman Resorts’ Amanikan and Amandira cruisers off Indonesia. – Rosa Ocampo

SINGAPORE

Industry experts in the Lion City are predicting that outbound business event traffic will be sustained but group sizes may shrink and cheaper destinations will be chosen.

Mice Matters’ director Melvyn Nonis, said: “Companies may reduce their group sizes to control their budget and perhaps even cut down the duration of trips by a day or two, but they will not stop rewarding their employees. Incentive trips are one of the highlights for many so (these events) will still continue.”

According to Nonis, insurance industry clients have been visiting the UK for several years and are hence looking to explore newer places like the US and South Africa. Moreover, with the spate of terrorist attacks in Europe, Nonis added that clients are shifting interest away from popular cities like Paris.

Theresa Lee, head of MICE, FCM Travel Solutions, has observed the same with her clients who are “deserting popular destinations for safer options like Fiji, Japan and South Korea”. And if they do go to Europe, Italy, Spain and Switzerland are preferred.

Lee is optimistic that the industries such as automobile, insurance, direct-selling companies, pharmaceutical and professional associations will continue to have a healthy appetite for overseas events in 2017, albeit with slight modifications to their usual programme to suit market conditions. For instance, she said companies may shorten trips from five days to four.

As for Michael Chiay, senior director, meetings & events, Asia Pacific with Carlson Wagonlit Travel, he said the weakening Australian Dollar and Malaysian Ringgit will work in the favour of corporates picking Sydney and Kuala Lumpur as destinations for meetings and events.

Significantly less expensive cities like Hanoi, Beijing, Ho Chi Minh City, Jakarta and Bangkok will remain attractive spots too, Chiay added.

According to Chiay, pharmaceutical companies will continue to drive MICE traffic.

He explained: “The stricter regulatory environment in the pharmaceutical sector means these companies need to have more meetings before new products can be launched.

“A healthy growth in MICE traffic is also expected from industries and organisations associated with the disruptive innovation movement, such as Fintech,” he added. – Paige Lee Pei Qi

VIETNAM

Asia is proving to be the most popular for Vietnamese companies planning their overseas events.

While the majority of businesses stay on home turf for incentive trips and events, an increasing number – with the banking, pharmaceutical, insurance, automobile and beverages industries dominating – are looking abroad.

Cambodia and Thailand are popular, along with Bali and the Philippines. Increased connectivity, competitive air fares and a rise in event facilities have helped boost the outbound market, said Robert Tan, business development director at Lac Hong Voyages.

He predicts Taiwan, South Korea and Japan will be popular with corporate clients in 2017. He said: “We expect to see an increase of about 20 to 35 per cent due to visas being easier to obtain.”

The country’s growing appetite for business events has also seen Saigontourist Travel Service Company enjoy a 30 per cent YOY increase in demand. It dealt with 10,500 event tourists in 1Q2016, of which 1,500 went abroad.

Thailand was the most popular destination, with 800 visitors from Vietnam, followed by South Korea (300 pax) and then Europe, the US and Japan.

Company director Vo Anh Tai said the increase was down to Saigontourist cutting prices for outbound corporate tours in 1Q2016 – a move that is being replicated in 2017.

Interest in South Korea is expected to continue, boosted after Vietravel signed an agreement with Gyeonggi province in April to attract business event groups from Vietnam. Under the move, Vietravel offers more tours to the destination and handles local administration. The company handled corporate trips for 5,000 Vietnamese to South Korea in 2015.

Increased external promotion and marketing from other countries is also expected to stimulate Vietnam’s desire for outbound business events and travel.

Jeff Redl, managing director of Diethelm Travel Vietnam, said: “Destinations around the world are stepping up their marketing efforts, giving rise to fierce competition. Several Asian destinations, including Hong Kong, Taiwan, South Korea, Singapore and Malaysia, have been proactively developing business event tourism and launching large-scale marketing campaigns.”

Pham Ha, CEO of Luxury Travel Vietnam said domestically, Hanoi, Danang and Ho Chi Minh City remain the most popular destinations for business events. – Marissa Carruthers

2016 Chinese business travel in review

Carlson Wagonlit Travel, China and TTG Events join hands to take the pulse of Chinese companies to learn how they are planning corporate travel and events, and the issues that concern them most

The business travel management industry in China has grown rapidly over the last decade. The Global Business Travel Association (GBTA) has reported that China surpassed the US as the top business travel market in the world in 2015, with US$291.2 billion in spend. It also forecasted that business travel spend in China will grow at 10.1 per cent in 2016 to US$320.7 billion.

The various stakeholders in China’s travel ecosystem have adapted to the fast- changing environment by developing and implementing better technology and solutions at an unprecedented pace. Chief among these industry players are travel management companies (TMCs), technology solutions providers, travel service providers (airlines, hotels, car rental companies), and the indispensable corporate travel managers. As the link between businesses and service providers, travel managers are often seen as the driving force of advancement in the industry; their views and requirements help shape the direction in which the industry develops.

For the 2016 Survey Report on Business Travel in China, Carlson Wagonlit Travel surveyed 113 Chinese corporate travel managers and meetings & events (M&E) professionals. Conducted early this year, the survey captured the opinions of respondents in corporate travel-related roles, including purchasing & procurement, administration, business travel management, meetings & conventions, general management and human resources & training.

Respondents were from a diverse range of industries such as life sciences & healthcare, technology, IT & software services, engineering & manufacturing, energy, mining, chemicals & utilities, professional services, automotive, transport and logistics.

The survey respondents answered multiple questions, falling under two broad domains – Transient Travel, and Meetings and Events.

For the Transient Travel section of the survey, respondents were asked to evaluate and rate the importance of nine market trends that would impact their companies’ managed travel programmes in 2016.

In the Meetings and Events section, they were asked to evaluate and rate the importance of six key trends in the meetings and events industry in China in 2016.

In both sections, the respondents also answered a series of follow up questions about their priorities, concerns, budgets and service expectations from TMCs.

Transient Travel findings

The nine trends in this section that the respondents were asked to rate can be broadly grouped into three categories:

1. Technology trends: comprising “Data security”, “Big data” and “Mobile technology”

2. Economic and political trends: comprising “Global economy”, “Corporate social responsibility” and “Political context”

3. Social trends: comprising “Millennials’ travel behavior”, “Sharing economy” and “Social media”

Technology trends were rated the highest in terms of their expected impact on business travel in China in 2016. These were followed by economic and political trends, and finally social trends that will have both a direct and indirect impact on business travel.

Compared with the 2015 survey results, the three technology trends retained their top spots and continue to be viewed as key drivers of the corporate travel industry in China. Interestingly, while “Data security” was rated the top trend in 2015 and 2016, “Big data” moved up to number two and “Mobile technology” dropped a spot to number three in 2016. The economic and political trends, and the social trends ranked the same as they did in 2015.

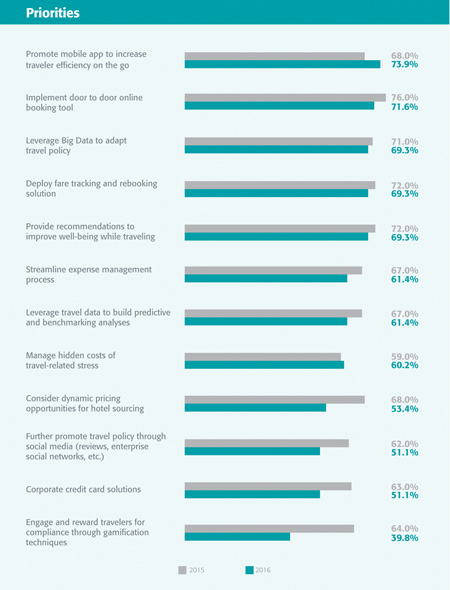

There was some movement in travel managers’ priorities for 2016, with promoting mobile apps to improve traveller efficiency moving up the ranks from number four in 2015 to number one in 2016. This comes as no surprise given the rapid adoption of smartphone usage in the travel industry.

Engaging and rewarding travellers for better compliance through gamification techniques was a less popular priority this year, as it dropped three spots from number nine to twelve.

Meetings and Events findings

In the meetings and events space, the development and use of technology was the trend that saw the biggest jump, ranked third in 2016, up three spots from last place in 2015.

Consolidation of meeting spend moved up a one place and replaced economic context as the top ranked driver, implying that there will be a much greater focus on managing costs this year.

The priorities of procurement teams in 2016 have also shifted when compared to 2015. Selecting and negotiating with suppliers moved up two spots to replace capturing and analysing spend as the top priority for procurement teams in 2016.

While capturing and analysing spend dropped three spots from last year to number four, consolidating meeting and event spend moved up two places to become the third most important priority for 2016.

The next few sections of this report present an understanding of the relevance of these trends to travel managers, and analyse their impact on managed travel programmes, meetings and events and travel suppliers.