Global business travel and events costs are set to climb higher through the remainder of 2023 and into 2024, albeit at a much more moderate pace than the exceptionally steep increases seen in 2022.

This is according to the 2024 Global Business Travel Forecast, published by CWT and Global Business Travel Association (GBTA).

Rising fuel prices, labour shortages, and supply chain challenges, coupled with red hot demand, caused travel prices to skyrocket in 2022 – far surpassing some of the increases outlined in last year’s forecast. Lingering economic uncertainty and a gradual easing of supply-side constraints are expected to result in more subdued price increases over the next 12 to 18 months, according to the report, which uses anonymised data generated by CWT and GBTA, with publicly available industry information, and econometric and statistical modelling developed by the Avrio Institute.

Air

The global average ticket price (ATP) of flights booked for business travel rose dramatically in 2022, experiencing record price increases. The ATP rose by 72.2% YoY to US$749 in 2022, far surpassing 2019 levels (US$670). While demand has recovered strongly with passenger numbers quickly approaching pre-pandemic levels, driven primarily by pent-up leisure travel demand, airline capacity continues to be constrained by labour shortages and supply chain issues. Looking forward, ATP growth is likely to be more modest at 2.3% in 2023 and 1.8% in 2024, albeit from an already high base. Still, many corporate buyers now have less leverage to negotiate with airlines, as their travel volumes remain below pre-pandemic levels.

At US$855, the Europe, Middle East, and Africa region recorded the highest ATP in 2022, compared to other parts of the world. This represents a 31.5% increase from 2021. More modest price increases are expected going forward, with ATPs predicted to rise 2.9% this year and 2.2% in 2024.

However, in terms of year-over-year growth, the ATP in Asia Pacific climbed 148.7% YoY in 2022 to US$567 – the biggest increase seen in any region, despite a lack of international travel demand from China. Key business travel destinations, including Australia and Japan, fully reopened to vaccinated travellers and resumed visa exemption arrangements. Average airfares rose 75.3% for Australia and 79.3% for Japan in 2022, with a sharp rise in the share of longhaul tickets. As airlines in the region – particularly the major carriers from China – continue to add more international route capacity, the increased supply should help ease price pressures in the region, with ATPs forecast to rise 4.8% in 2023 and 2.7% in 2024.

Hotel

Like air travel ATPs, the global average daily rate (ADR) for hotel bookings exceeded earlier predictions, rising 29.8% YoY to US$161 in 2022. Occupancy rates have been high, but so have labour, energy, and F&B costs. In fact, several cities across the globe including London, Miami, and Singapore, reported their highest ADRs on record in 2022. Meanwhile, hotel construction remains down from its pre-pandemic peak, creating supply constraints. With fewer properties to compete against, existing hotels can sustain their pricing power for longer, even though ADR gains are slowing. ADRs are projected to climb a further 4.3% in 2023 to US$168, followed by a 3.6% increase to US$174 in 2024.

North America saw the highest growth in hotel ADRs of any region in 2022, rising 33.8% YoY to US$174. Occupancy in the region is expected to grow at a slower pace in 2H2023 and 2024 due to economic concerns, with ADRs forecast to rise 4% to US$181 in 2023 and 3.3% to US187 in 2024.

ADRs in Latin America also rose sharply by 26.9% YoY in 2022, as several countries in the region experienced double digit inflation. Now, with inflation appearing to have peaked, and ADRs are expected to grow by 9.1% in 2023 and 5.6% in 2024.

Ground transportation

Car rental supply has been constricted as companies sold vehicles during the pandemic when demand collapsed. As business returned, vehicles were not replaced at pace due to supply chain issues, largely due to a worldwide shortage of vehicle semiconductors which led to inflated vehicle prices. These factors have contributed to prices rising by 9.8% YoY in 2022, with a further 6.7% increase forecast this year. Pricing growth is expected to cool to 2.1% in 2024.

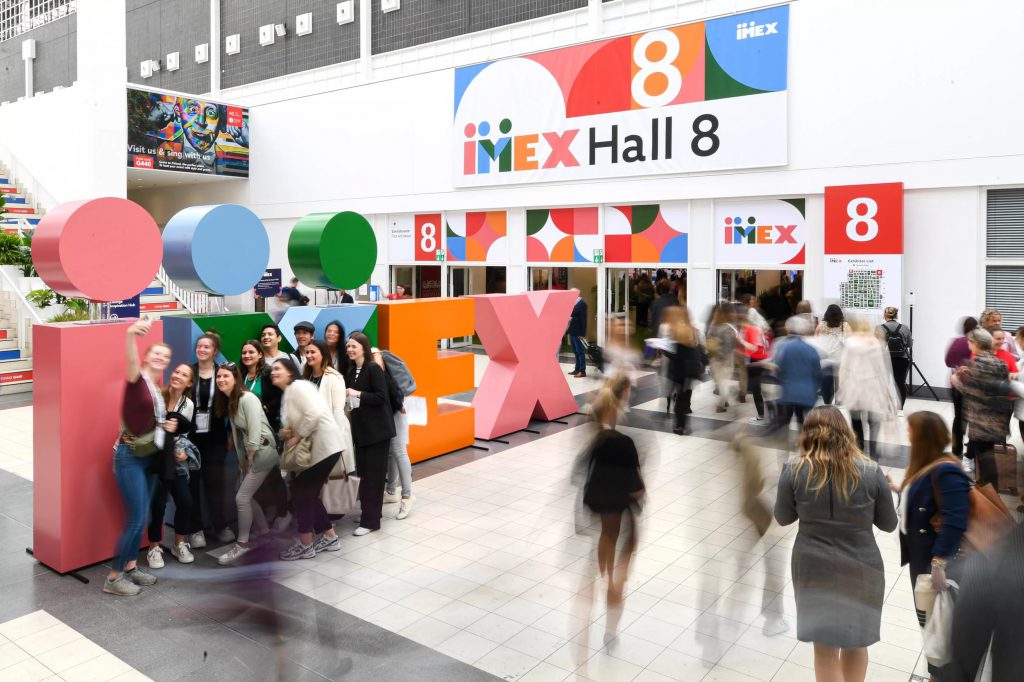

Meetings and events

In-person meetings and events have rebounded more robustly than many had expected. Client acquisition and relationship building are key business goals that are not easily executed virtually. There has also been exceptionally strong demand for incentive trips, as companies seek to motivate and reward employees. In fact, CWT Meetings & Events has observed these trips becoming longer and more frequent and expects the trend to continue.

The average daily cost per attendee was US$160 in 2022. This is expected to increase to US$169 in 2023 and then US$174 in 2024.

Lead times for events remain short in this post-pandemic world. However, organisers should now look at 2024 with a 12-month planning cycle if they want to keep prices at a reasonable level. At the same time, consolidating transient travel and M&E spend can give buyers more leverage when it comes to negotiating pricing.

The full report can be downloaded here.