Global business travel is forecast to see an uptick in 2023 versus 2022, travel suppliers anticipate an increase in corporate travel spending with companies expected to send more employees on trips, according to the Global Business Travel Association’s (GBTA) 1Q2023 Business Travel Outlook Poll.

Other survey findings sectors such as finance, insurance, professional services, and consulting are showing stronger signs of growth in travel spending; as well as a mixed outlook on China travel.

Here are the key takeaways from this latest GBTA poll:

Back on the road and in the air − more business trips are expected in 2023.

Business leaders may anticipate a recession this year, but travel managers are anticipating more business travel. Three in four travel managers (78%) expect their company will take a lot more (22%) or more (55%) business trips in 2023 versus 2022.

Only 15% of travel managers expect to see the same levels of business travel as last year, and seven per cent expect fewer or a lot fewer trips.

An overwhelming 90% of respondents believe their employees are willing to travel for business, while 88% report feeling more optimistic about the path to recovery compared to last month.

Companies are also expected to increase their business travel spending.

Travel suppliers expect more business travel spending by their corporate customers in the year ahead. Almost nine in 10 suppliers (86%) expect spending by corporate customers in 2023 will be much higher (26%) or somewhat higher (60%) compared to 2022. (This marks an increase from GBTA’s October 2022 poll where 80% of suppliers expected spending to increase.)

Nine per cent expect corporate business travel spend to be about the same, and only one per cent expect spending to be lower than in 2022. (In the October poll, 15% expected the same level of spending and 5% expected lower spending.)

Business travel bookings and spending continue making their way back to 2019 levels.

On average, travel buyers estimate their companies’ current domestic business travel bookings have returned to 67% of pre-pandemic 2019 levels (up from 63% in GBTA’s October poll). Travel buyers estimate their company’s current domestic business travel spend is back to 68% of their 2019 spend levels.

International business travel continues to gain ground. In this poll, on average, travel buyers estimate international business travel bookings have recovered to 54%, up slightly from 50% in October. Current spending for international trips is back to approximately 58%.

What industries are leading and lagging in returning to business travel spending?

When asked to assess the industries of their corporate clients where they’ve seen the strongest growth in business travel spending in 2022, travel suppliers cited their top three a finance and insurance (34%); professional, consulting, scientific, and technical (32%); and software, hardware and technology (25%). These industries largely resumed travel last year after lagging other industries – such as manufacturing –in 2021.

When asked which industries have seen the weakest growth in travel spending last year, travel suppliers and travel management professionals cited: non-profits, associations, and foundations (35%); software, hardware, technology (24%); and educational services (22%).

Interestingly, the software, hardware and technology sector was cited as both leading and lagging in spending growth, indicating variances among companies and industries in terms of approaches, travel policies, and strategies.

Trip type and intent continue to drive business travel spending and approvals.

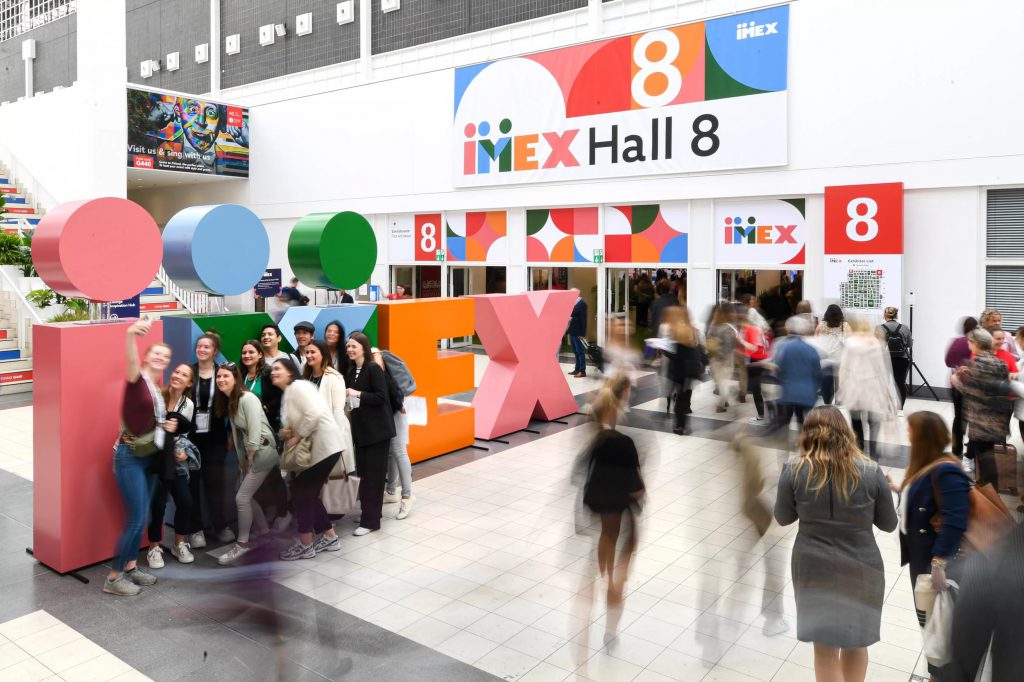

According to travel buyers the top areas for business travel spending in 2023 are sales/account management meetings with customers or prospects (28%); internal meetings with colleagues (20%); and conferences, trade shows and industry events (18%), which is largely consistent with GBTA’s June 2022 poll.

Rounding out the spending mix are customer service trips (14%); employee training or development (nine per cent); and supplier meetings (six per cent).

During the pandemic, many travel programmes implemented stricter pre-trip approval processes to manage risk. Add to that the desire to control costs or align to greener travel practices, and employee travel may now require additional approvals – such as from Risk, HR, senior leadership, finance or the travel or CSR departments. Twenty-two percent said pre-trip approval is required all the time for domestic travel and 34% said pre-trip approval is always required for international travel. An additional 20% said pre-trip approval was required some of the time for domestic or international travel.

However, half (49%) of travel buyers say pre-trip approval is never required for domestic business travel, while one-third (31%) say the same for international travel.

Staffing for travel suppliers is still suppressed but help may be on the way in 2023.

Travel suppliers and travel management companies were forced to reduce staff during the pandemic−even now, many of these companies are not yet fully re-staffed. Almost half of travel suppliers (47%) report their company’s staffing level is somewhat or much smaller than it was pre-pandemic, while 28% say it is about the same.

However, two in three travel suppliers (65%) expect staffing will increase a lot or somewhat in 2023 compared to 2022, while 26% expect no change.

Company travel programmes hold their (pre-pandemic) ground when it comes to staffing.

While many travel suppliers emerged from the pandemic with fewer staff, the same has rarely happened with travel programmes. The majority of buyers (78%) say their company’s travel programme staff size in 2023 is expected to be about the same (56%) as it was pre-pandemic or will be much or somewhat larger (22%).

Many buyers also expect to increase spending for their travel programme operations (such as staff salaries, technology, and consultants) in 2023 versus last year. Almost half of buyers (45%) expect their travel programme budgets will be higher, while 41% expect them to be about the same as in 2022.

Industry sentiments are mixed on business travel and China.

As it opens its borders to travel, China has seen a rising number of Covid-19 cases and some countries – including the US, Italy and Japan – have re-introduced testing requirements for inbound passengers from China. Among all respondents, 56% support policies requiring proof of a negative COVID-19 test or proof of recent recovery in order to enter, while 18% believe requirements should be less strict, and 18% are uncertain. Of those supporting the policies, 54% were US-based and 59% were non-US-based.

Almost half thought these policies would lead to a significant (15%) or moderate (37%) decrease in the amount of business travel to and from China, while one-quarter (26%) didn’t think there would be an impact and 18% were not sure.

One in four (24%) S travel buyers report their company employees are typically allowed to travel to China, while 28% say employees are allowed but the company recommends against it. An additional third (29%) say employees are typically not allowed to travel to China and 19% are unsure.

In total, 637 business travel buyers, suppliers, and industry professionals around the world participated in the survey that was fielded from January 16-26, 2023.