Companies’ belt tightening is presenting LCCs the opportunity to expand into the corporate sector with offers such as add-on services and ease of booking through GDSs. By Paige Lee Pei Qi

More corporates are turning towards the buoyant low-cost carriers (LCCs) sector as a way to keep travel costs down while budget airlines in general evolve to cater to this market.

ASEAN countries were among the first to adopt the idea of LCCs in Asia, starting in 2002 with Malaysia-based AirAsia. With attractive airfare offers by LCCs, more travellers started booking their way into short, impulse holidays to nearby destinations.

Corporates have started to come into the picture too, especially the bottomline-conscious small and medium-sized enterprises (SMEs), which are now booking their executives on LCCs instead of full-service carriers, slashing their budget for regional travel.

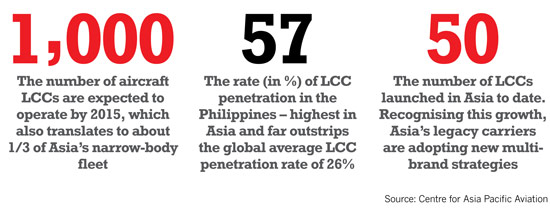

Todd Arthur, vice president, sales & account management, Asia-Pacific, BCD Travel and also Asia board member of Association of Corporate Travel Executives, said: “LCCs now account for over 15 per cent of Asia’s fleet which outstrips the growth of full-fledged airlines.

“The bulk of the new aircraft is all coming from the LCCs and these are evolving into hybrid carriers to expand into the corporate market.”

Hence to increase their allure to this corporate market, the LCCs have been dishing out additional add-on benefits catered to the busy corporate traveller.

Logan Velaitham, CEO of AirAsia, Singapore, said: “Keeping our unit cost low to offer low fares is key to the success of our business model.

“However, as travellers from other segments are embracing LCC, we are now also offering value-added services such as our Hot Seats, in-flight meals and insurance for a fee without compromising our unit cost – all with the objective to boost ancillary revenue.”

According to Velaitham, AirAsia has seen “a big increase” in the business traveller segment over the years, especially with premium offerings like the Red Carpet Service.

Last February, AirAsia rolled out the new Red Carpet Service that costs an additional S$60 (US$48) – for travellers who are looking for a speedier travelling process from check-in to landing.

The Red Carpet privileges include a dedicated check-in area, priority baggage tagging and loading, access to the lounge, fast-track immigration and security clearance as well as priority baggage delivery upon arrival.

Likewise for Jetstar Asia, corporate travellers can choose to add on checked baggage and a bundle to better suit their needs. The bundle may include free seat selection, food and beverages and a waiver of change fees. Business class passengers with Qantas Club membership can also access the Qantas Club lounges.

Barathan Pasupathi, CEO, Jetstar Asia, said: “With a tight travel budget to manage, executives of SMEs and MNCs alike will look for services that offer bargain deals.

“Low-fare airlines, budget hotels and the like are top of their needs when planning business trips.”

Highlighting that Tigerair has seen a “significant increase” in corporate travel, Ho Yuen Sang, COO of Tigerair, said: “Corporate travellers (especially) like our ease of ticket booking at the last minute, especially for the short sectors, and our competitive fares.”

Mike Orchard, senior director, Asia-Pacific, Carlson Wagonlit Travel Solutions Group, said: “While LCCs have historically targeted leisure travellers, today most see the value of working with business travel clients as well, and are actively pursuing corporate customers.

“To woo corporates, LCCs have taken a variety of measures, such as amending their product to offer free checked bags and zero change fees.

“Furthermore, some LCCs in Asia-Pacific have begun to participate in the global distribution system (GDS), making it easier for companies to book flights on these airlines through their corporate travel agencies.”

Indeed, more LCCs have turned to GDSs, making it easier for travel consultants to access their content and drive sales. For instance, since the end of last year, the services of 26 LCCs worldwide are bookable via Abacus.

Hailing the lower price point as its main draw, Orchard added: “The key advantage of using LCCs is the cost – which are 20 per cent cheaper, on average, than full-service carriers.”

According to Velaitham, destinations like Kuala Lumpur, Jakarta and Bangkok are most popular among their business travellers, largely due to the flight frequency provided as well.

However, pointing out existing constraints with LCCs, Orchard said: “As they are driven by the goal to operate at the lowest cost possible, LCCs fly more point-to-point routes while full-service carriers use the hub-and-spoke system, which can make booking connecting flights challenging.

“Many LCCs fly to secondary airports and this can incur additional ground transportation costs that can cancel off the savings from the cheaper airfare.”

Likewise for Joana Yap, general manager, HRG Singapore, who highlighted that while her clients will request for an LCC option for price comparison, most will still opt for full-fledged airlines ultimately.

“At the moment, it is not the corporates’ mandate to use LCCs because given the choice, most of them will still prefer a flight that provides everything from baggage to meals.

“While companies may look at various ways to keep their travel budget tight, corporate travellers will use the reasoning that full-fledged airlines promise good productivity to get away (from LCCs),” said Yap.