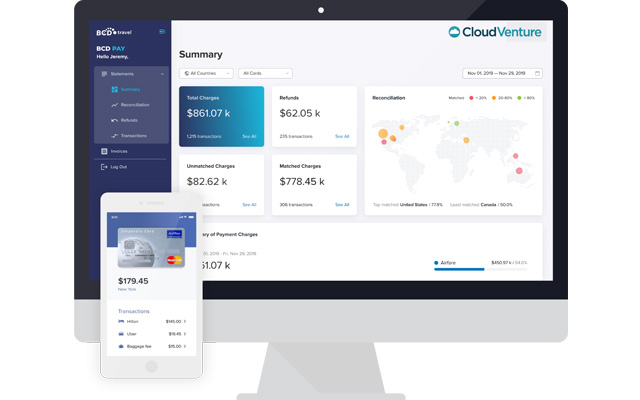

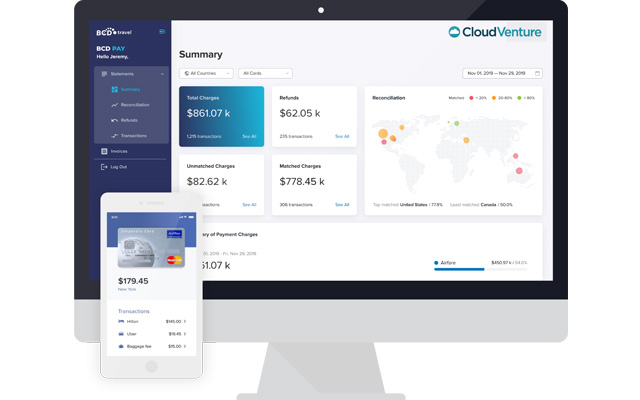

BCD Pay is a new cloud-based platform from BCD Travel that has been described by the company as a “frictionless digital payment experience from trip booking and payment through reconciliation”.

Available to clients as an add-on subscription, the new BCD Pay is a suite of solutions that use artificial intelligence, machine learning and open APIs to simplify, digitise and automate corporate travel payment, reconciliation and invoice management.

It provides seamless orchestration of payment, invoices and receipts during the trip and features an automated console to review, reconcile and audit T&E spend management, invoices, receipt, credit card and expense transactions.

BCD Pay’s functionalities were designed to address key pain points for its corporate travel clients, the TMC said.

A recent BCD survey found that more than half of clients struggled with missing invoices and receipts, credit card reconciliation, and the quality of expense and spend data. Meanwhile, more than 25 per cent of clients cited challenges in managing payments for meetings, events and non-employee travel, especially with the post-Covid rise of hybrid work.

Ajay Singh, vice president, digital payment and expense products, said in a statement: “BCD Pay eases the burden of travellers, who are looking for a simple process with no need to make payments or expense claims. It helps managers maintain and improve control over payment for corporate travel, meetings and events and get greater payment visibility. It also frees up management time by automating manual tasks related to reconciliation and workflow, and enriches data transfers by streamlining the T&E spend management process.”

During pilot testing, BCD Pay has shown a 75 per cent improvement in the cycle time of end-to-end data ingestion, reconciliation, reporting and data integration across a fragmented ecosystem of back offices, ERP systems and credit card issuer systems.